Did you know that legacy systems can increase your annual maintenance expense by up to 15%? Legacy trading systems have long served as the financial industry’s backbone. However, these systems have significant flaws that prevent banks from keeping up with the changing regulatory landscape and attaining maximum efficiency.

In this blog, we will look at the issues that older trading systems face, the importance of upgrading to modern technology, the advantages of switching to Calypso, and how Quinnox, partnering with Adenza, can help in this transition journey.

Shortcomings of Legacy Trading Systems:

But before we delve into the solutions that Calypso can help with, let us discuss some of the challenges of legacy trading systems:

- Outdated and complex post-trade platforms that limit business growth and innovation. Moreover, with old IT system in use there is a risk that firms will be faced with significant challenges when wanting to take advantage of new market opportunities, deal with changes in regulation, or address increasing costs

- Labour intensive processes – Staff development is critical and may take as many as 6 months to 1 year, which can lead to client dissatisfaction and operational losses

- Expensive and cautious post-trade transformation that delays the delivery of value to clients

- Limited workflow automation and efficiency force reliance on email, spreadsheets, manual data imports, and in some cases even paper or faxes that restrict the potential for new services and markets. In times of high volatility, these manual processes can result in some real risks. Lack of workflow automation can also lead to a Disconnect between Exchange and Central Clearing Parties (CCP) workflows and systems.

- Regulatory Reporting – Complex and demanding regulations that increase compliance risk and fines. Non-compliance with regulations such as the Dodd-Frank Act and European Market Infrastructure can have drastic outcomes that are not good for the organization and its stakeholders.

- Integration with other systems – Poorly integrated legacy IT systems that impair data quality and security.

These shortcomings result in higher costs, inefficiencies, increased risk, and an inability to meet the demands of current trading operations.

Now that the wave of regulations is nearing its end (Basel III, for instance, implemented on January 1, 2023) and with the recent collapse of known banks, there is dire need to start employing streamlined technology to take advantage of available data to identify and tackle risks – something legacy systems do not offer.

Why Migrate to Modern Technology?

To overcome the limitations of legacy trading systems, it is crucial for financial institutions to embrace modern technology. For organizations still running legacy systems, maintenance alone can account for a significant proportion of any IT budget, and the cost of inflexibility can stifle innovation. Running operations on legacy systems does not just increase costs and inefficiencies but also welcomes unnecessary risk.

Global investment banks are spending vast sums each year on their brokerage fees and billing operations, but data challenges, lack of automation, and legacy technology make it difficult to understand and therefore optimize their spend across the organization fully

Migrating to modern trading systems such as Calypso helps banks to address the challenges posed by complex regulations, automate processes, enhance risk management, and improve operational efficiency. Modern technology provides the agility, integration capabilities, and compliance functionalities necessary to thrive in the trading industry.

Why Calypso?

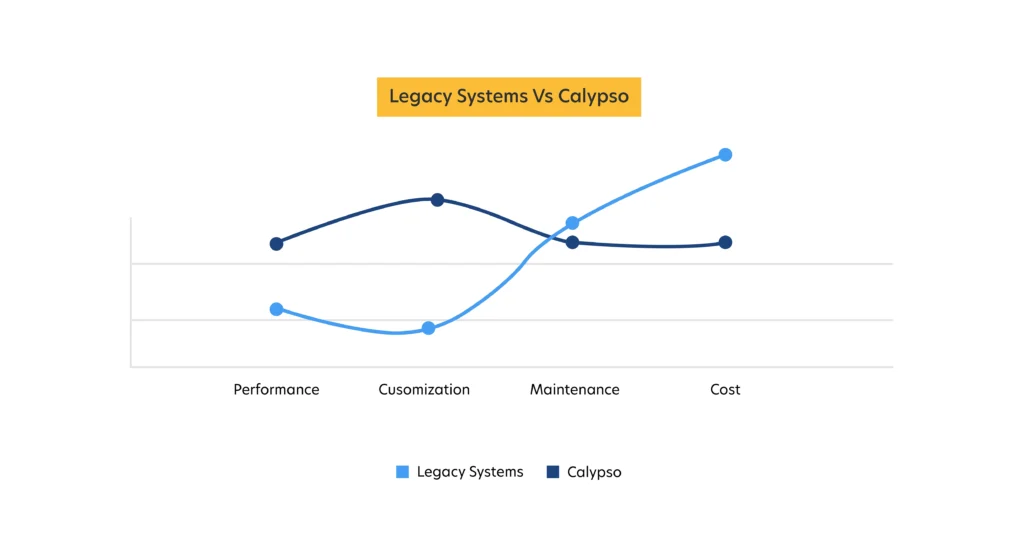

Calypso is a better choice than legacy systems for several reasons. Calypso offers better performance, more customization options, lower maintenance, and lower cost.

Moreover, Calypso has announced Project Simplify, an initiative that transforms how we deliver software updates. With Project Simplify, you will enjoy faster and easier access to security patches, software enhancements, and significant technological innovations. Project Simplify will help you run the Calypso platform at its best, with full functionality and minimal hassle.

A new study by Coalition Greenwich, based on conversations with over 30 senior bank executives overseeing trading and risk functions at top-tier and regional investment banks across the United States, Europe, and Asia, suggests:

As tech is upgraded, most banks are looking at platform-based providers as a route to cutting costs and increasing automation and are open to working with F-Fintech partners

Benefits of Transitioning to Calypso:

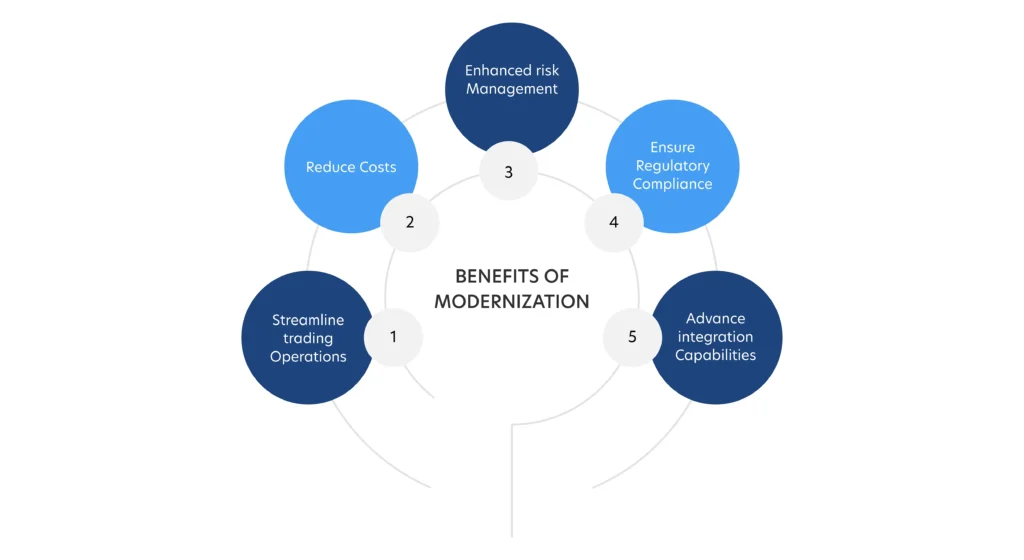

Calypso, a leading modern trading system, offers a wide range of benefits for financial institutions transitioning from legacy systems. By leveraging Calypso’s advanced features, banks can streamline trading operations, reduce costs, enhance risk management, improve client on boarding processes, and ensure regulatory compliance. Calypso’s integration capabilities, analytics support, and automation features empower banks to achieve operational excellence, mitigate risk, and drive growth in the ever-changing trading landscape.

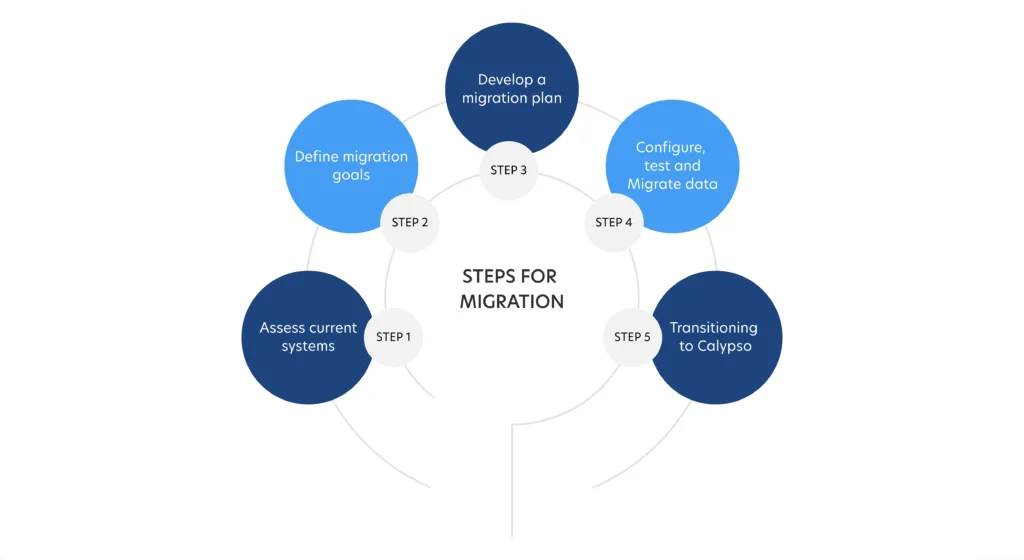

To ensure a smoother transition into Calypso, we at Quinnox follow a systematic approach:

- Assess current systems : Our SMEs will evaluate your existing systems and identify their strengths and weaknesses. We will also understand your business requirements and expectations from Calypso’s perspective.

- Define migration goals and objectives, considering cost, time, quality, performance, security, and compliance factors. We will also help you prioritize the features and functionalities you want to migrate first.

- Develop a detailed migration plan outlining the scope, timeline, budget, resources, risks, and mitigation strategies.

- Configure the Calypso platform according to your specifications and requirements.

- Test the platform for functionality, compatibility, and performance. Then we will help you migrate your data from the legacy systems to Calypso using the appropriate tools and methods.

- Transition to Calypso, ensuring that it can be used for your operations. We will also help you monitor and troubleshoot any issues that might arise during the transition period.

Quinnox Partnership with Adenza For Calypso Services:

Here is why Quinnox and Adenza are your ideal partners for migrating from legacy trading systems to Calypso, the leading provider of cross-asset trading software.

- 16 years of partnership with Adenza

- A Data Migration Framework that includes Domain & Technical experts, Migration and Reconciliation Accelerator tools, and best practices for data conversion and validation. Qmigrate can transform data into the Calypso Data Uploader format using Qconvert and then import data into Calypso. Our framework supports Migration from known trading systems to Calypso

- Quinnox has a proven track record of delivering Calypso solutions to 15 global financial institutions, with a 30% reduction in the total cost of ownership.

- Quinnox has a team of 150 trained Calypso resources with an average of 12+ years of domain expertise.

- Quinnox also offers innovative tools such as QMigrate, Qframe, and Smartcompare to accelerate data migration, automation testing, and reconciliation for Calypso and legacy applications.

- Quinnox leverages its expertise and experience to offer Front to Back Calypso implementation, data migration, customization, integration, quality assurance, and ongoing support.

Together, Quinnox and Adenza ensures a smooth and successful transition to Calypso, allowing you to harness the full potential of Calypso and optimize your trading operations front to back.

Conclusion:

Modernizing legacy trading systems by transitioning to Calypso is essential for financial institutions to overcome the shortcomings of outdated technology. By embracing modern technology, banks can enhance efficiency, improve risk management, streamline workflows, and ensure compliance with evolving regulations. The partnership between Quinnox and Adenza provides the necessary expertise and support to facilitate a seamless transition, enabling organizations to unlock the full potential of Calypso and thrive in the modern trading finance landscape.

Moreover, its high time that Banks make the transition move towards Calypso to simplify, streamline and standardize trading floor technology to scale up their businesses in the future. We would urge you to adapt to the modern days trading applications, connect with us, and we can help you decide the next steps in your transformational journey.

Reach our experts to to get started today!