As companies worldwide strive towards sustainability, ESG trends remain at the forefront of business operations. According to a Gartner Survey, chief executive officers reported that after profit and revenue, investors now place environmental and social reforms in the top three of their priorities.

Responsible investors are incorporating ESG criteria into their investment strategies, and companies are adopting more sustainable practices to meet the growing demand for ESG-driven products. As a result, businesses must spend more money on creative solutions that address ESG requirements to achieve sustainability targets.

According to Fact.Mr Report, the global ESG market is poised to reach a valuation of US$ 39.3 billion in 2023 and is estimated to grow at a CAGR of 6.3% and jump to US$ 72.4 billion by the end of 2033.

ESG reframes markets and plays a crucial role. However, new concerns about geopolitics, energy security, and greenwashing have cast doubt on the effectiveness of ESG. Despite these concerns, ESG continues to be a valuable tool for evaluating long-term risks and shifting market conditions.

This blog delves into the emerging ESG trends that businesses should focus on to achieve their sustainability goals:

1. Rise of ESG Integration:

The rise of ESG integration among businesses highlights the importance of sustainability and responsible investing among investors and companies, leading to a shift towards more holistic approaches to investment analysis and decision-making. ESG Integration incorporates ESG factors into investment decision-making processes, considering their impact on a company’s long-term financial performance.

For example, the largest asset manager in the world, BlackRock, declared its commitment to ESG integration across its $9 trillion worth assets under management. The investment company is focused on making the transition to a sustainable future and are working to match their portfolios with net-zero emissions.

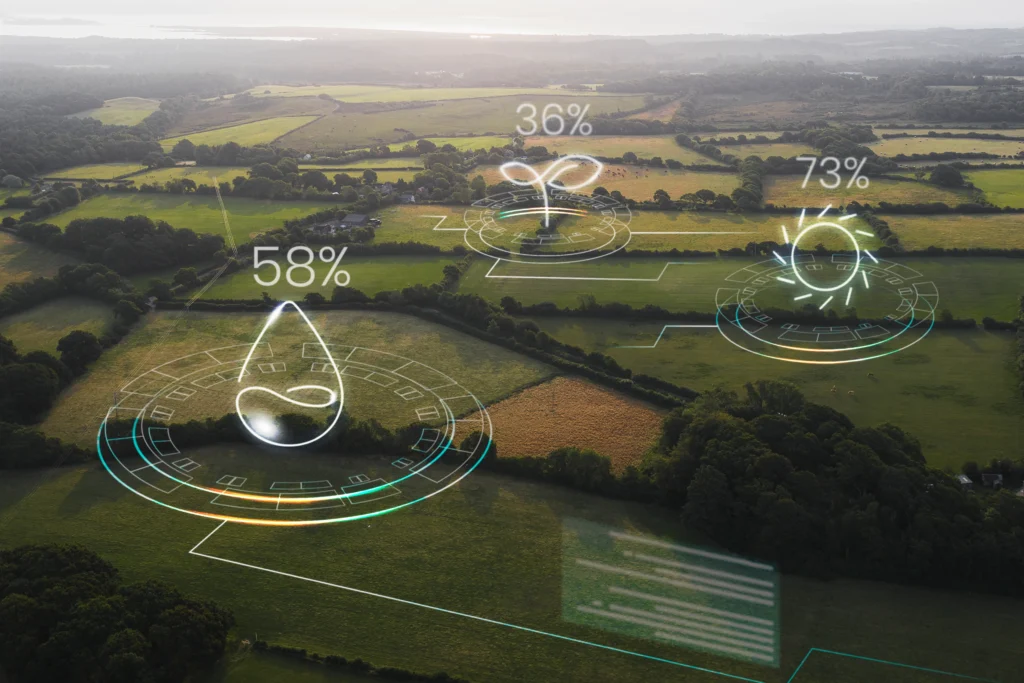

2. Technology Advancements to Sustainability:

Technological advancements play a vital role in promoting sustainability. The Global e-Sustainability Initiative (GeSI) report estimated that digital technologies could help achieve a 20% reduction in global carbon emissions by 2030.

For Instance, renewable energy technologies like solar and wind power help reduce carbon emissions, mitigating climate change. Additionally, innovations in battery storage enhance energy efficiency and enable grid stabilization. Smart grids and IoT devices optimize resource consumption, reducing waste. Such technologies contribute to ESG goals by fostering environmental preservation, social equity, and efficient governance of resources.

3. Circular Economy and Waste Reduction:

According to research by Ellen MacArthur, fast-moving consumer items contain material worth around $2.6 trillion annually, 80% of the material value is lost and never recovered. Businesses and organizations that successfully integrate circular economy into their product strategy stand to gain significant value for their customers.

Circular economy is an economic model that aims to minimize waste, promote resource efficiency, and maximize the value of products and materials. Companies should consider how to integrate the circular economy into the lifecycle of their products to meet consumer demands. Further, companies should re-evaluate their impact and how their products fit into the circular economy.

4. Climate Action and Transition:

According to the CDP’s 2020 Global Climate Change Analysis, 54% of businesses globally have pledged to achieve net-zero emissions by 2050. As the need to combat climate change becomes more pressing, businesses will be under more pressure to make quick decisions and cut their carbon emissions. This entails establishing challenging goals for emissions reduction, switching to renewable energy sources, and incorporating climate risk into corporate plans. Furthermore, there will be a stronger emphasis on transitioning to a low-carbon economy and encouraging renewable energy sources.

5. Stakeholder Engagement and Governance:

In 2023, organizations must focus on effective stakeholder engagement and effective governance procedures. To understand the challenges and expectations of stakeholders, including employees, customers, communities, and investors, businesses will need to actively connect with them. This will necessitate transparent communication, strong governance frameworks, and the inclusion of various viewpoints in decision-making processes.

6. Supply Chain Transparency:

According to CDP, it claims that the impact of end-to-end supply chains on emissions is more than five times greater than the impact of a business’s direct activities. Moreover, better environmentally friendly supply chains, including direct operations, can also translate into significant financial and commercial benefits for businesses, particularly in the long run. Such benefits can be lower operating costs, a superior brand, and better access to resources.

7. Diversity, Equity, and Inclusion (DEI):

Organizations will prioritize DEI activities to promote inclusive work environments and eliminate structural biases. Diverse representation at all levels, fair practices, pay fairness, and giving underrepresented groups equal opportunities will be the main areas of focus.

8. Green transition for UK Micro Businesses:

Sustainable working is a key trend. According to COP26, a UN Summit on climate change says that UK SMEs have made substantial progress in their efforts to combat climate change. Over 53% of UK SMEs made investments in sustainability over the past year, spending an average of £61,250 on sustainability initiatives. In fact a research from Aldermore, the average SME business plans to make additional investments in sustainability over the next year, spending £78,392 on average (an increase of 27%!).

9. Standardization and Metrics for ESG Data:

Global standard-setting initiatives are gaining traction, which makes it simpler for investors to evaluate and compare ESG performance. Standardized ESG data and indicators are increasingly necessary to enable informed decision-making. To evaluate ESG performance and risks across many companies and industries, investors need consistent and comparable information.

For instance, the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB) are pioneering the development of ESG reporting standards that are industry specific. Companies are using these frameworks more frequently to increase accountability and transparency.

10. Water Stewardship:

Water stewardship is an emerging ESG trend that emphasizes sustainable water management solutions. According to the World Economic Forum, over 40% of the world’s population is impacted by water scarcity. Due to this, there is now more emphasis on businesses taking accountability for their water usage and effects on community populations.

Organization for Economic Co-operation and Development (OECD) forecasts that global water demand for manufacturing industries will increase by 400 percent from 2000 to 2050. As a result, investors and stakeholders are increasingly demanding transparency and action on water management, making it a critical ESG factor for businesses worldwide.

Final Thoughts:

ESG trends have become a significant factor in recent years that is reshaping the business landscape. ESG factors must be considered when making decisions, as both businesses and investors are increasingly realizing.

ESG developments are being driven by several factors, such as legislative requirements, changing customer preferences, and a growing understanding of the connection between sustainability and financial performance. As a result, businesses that avoid ESG principles run the danger of losing their goodwill, facing legal action, and having less access to financial support.

How do you see your organization’s sustainability goals changing or impacted by these trends?

With an innovative and forward-thinking approach, Quinnox has been instrumental in enabling businesses to align their sustainability initiatives with long-term growth strategies. By leveraging technology and expertise, Quinnox empowers organizations to optimize their operations, reduce their environmental footprint, and foster social responsibility. Our ESG-focused solutions can drive organizations towards positive change, help achieve sustainability targets, and create a better future while fostering continued business growth.

Connect with our Consultants today to achieve your ESG goals!