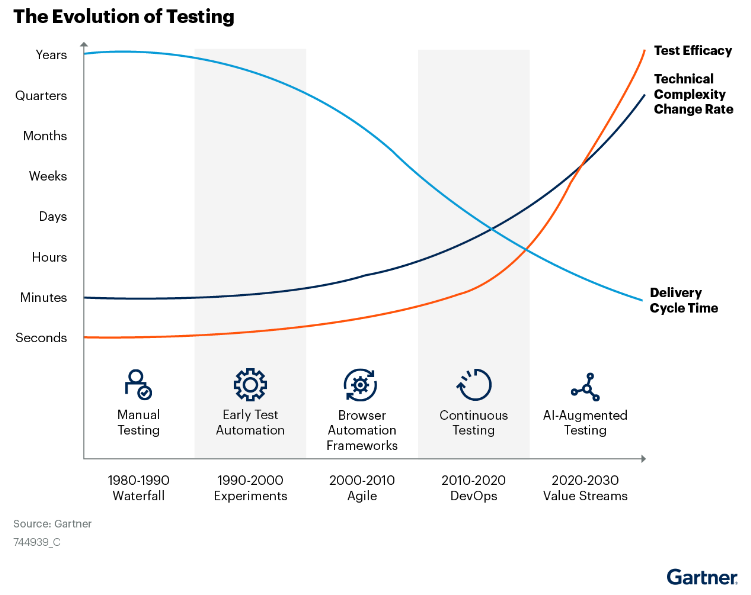

According to Gartner, 30% of enterprises will incorporate an AI-augmented testing strategy into their operations by 2025. Interestingly, the rapid evolution of technology has reshaped the banking landscape, leading to increased reliance on software applications for key operations and services.

With this reliance comes the need and demand for sophisticated features, including real-time transactions, personalized services, and advanced analytics. Consequently, the necessity of comprehensive and efficient testing methodologies witnesses a rapid rise. These testing methodologies are important to ensure the reliability, security, and compliance of banking software.

Since traditional testing methods often fail to meet the demands of modern banking applications, the shift toward automated testing becomes more crucial. The groundbreaking advancements in AI technology propelled by ChatGPT, DALL·E, and Copilot confirm this shift.

Automated Testing vs. Manual Testing

Automated testing is a software testing method designed to streamline software functionality and ensure compliance before its deployment, eliminating the need for manual intervention. According to industry reports, automated testing can help achieve up to 90% faster testing cycles compared to manual testing, significantly reducing time-to-market for banking software updates and releases. This speed advantage is crucial in the fast-paced financial industry, where rapid deployment of bug-free software is essential for maintaining a competitive edge.

In fact, several studies have also revealed that automated tests can achieve a test coverage of over 85%, ensuring comprehensive validation of all functionalities within banking software systems, minimizing the risk of undetected bugs or vulnerabilities, enhancing overall software quality and security. With automation, repetitive tasks are executed consistently, leaving no room for human error, thereby boosting the robustness of banking software applications.

Furthermore, the integration of AI-driven automated testing approaches is fueling this test culture transformation by leveraging advanced algorithms to analyze complex data sets, predict potential issues, and optimize testing outcomes. By harnessing AI capabilities, banks can achieve higher levels of precision, speed, and coverage in their testing practices, paving the way for a new era of innovation and excellence in the banking industry.

Key Types of Automated Testing

- Unit Testing – Unit testing involves testing individual components or units of code in isolation to ensure they function correctly. Unit testing helps identify defects early in the development process and facilitates code refactoring and maintenance.

- Integration Testing – Integration testing evaluates the interactions and interfaces between different modules or components of an application. Tools such as Selenium, TestNG, and Postman are commonly used for automated integration testing of web applications.

- Regression Testing – Regression testing verifies that recent code changes have not adversely affected existing functionalities. Automated regression tests are executed repeatedly to ensure that new updates or features do not introduce unintended regressions.

- Functional Testing – Functional testing validates the functional requirements of the software to ensure it behaves as expected.

- Performance Testing – Performance testing assesses the responsiveness, scalability, and stability of the application under various load conditions.

- Security Testing – Security testing evaluates the robustness of the application’s defenses against security vulnerabilities and threats.

Benefits of Test Automation in the Banking Industry

Test automation is revolutionizing the way banks develop, deploy, and maintain their software applications, offering numerous benefits that extend far beyond traditional testing methods.

Streamlined Software Development Processes

With automated testing frameworks in place, banks can rapidly execute test cases, identify defects early, and perform software updates more efficiently. This streamlined approach not only reduces Time to Market (TTM) for new features and products but also enhances overall development agility.

Improved Software Quality and Reliability

One of the most significant benefits of test automation in banking is the improvement in software quality and reliability. By automating test cases, banks can ensure thorough testing coverage across various functionalities and use cases, reducing the risk of bugs, errors, and system failures.

Enhanced Regulatory Compliance

In an industry as highly regulated as banking, compliance with regulatory requirements is paramount. Test automation plays a crucial role in ensuring regulatory compliance by automating the execution of compliance-related test cases and validation checks.

Increased Operational Efficiency and Cost Savings

Test automation drives operational efficiency and cost savings by reducing the reliance on manual testing efforts and optimizing resource utilization.

Automated tests can be executed round-the-clock, enabling banks to allocate their resources with better efficiency. Ultimately, it leads to higher cost savings and more organized operations.

Enhanced Customer Experience and Satisfaction

By delivering high-quality, reliable, and secure software applications, banks can build trust with their customers. Automated testing ensures that banking services function seamlessly across digital channels. As a result, customers have hassle-free and personalized banking experience.

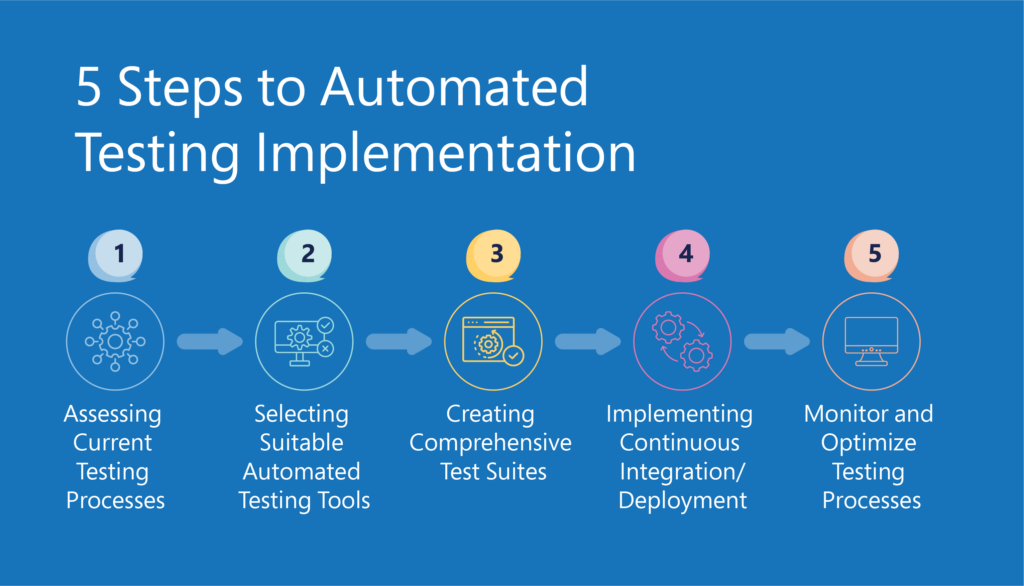

How to Get Started: Implementing Automated Testing within Banking Application Development

Implementation of automated testing for banking software development requires careful planning and execution to achieve cost savings, improved software quality, and enhanced customer experience. Here are actionable steps and best practices:

1. Assessing Current Testing Processes

Evaluate existing testing processes to identify areas where automation can be most beneficial. Determine the types of tests (e.g., unit tests, integration tests, regression tests) that can be automated to maximize efficiency.

2. Selecting Suitable Automated Testing Tools

Research and select appropriate automated testing tools that align with your application’s technology stack and requirements. Consider factors such as ease of use, scalability, integration capabilities, and support for different types of tests.

3. Creating Comprehensive Test Suites

Develop comprehensive test suites that cover all critical functionalities and scenarios of the banking application. Prioritize tests based on business impact and frequency of use, focusing on high-risk areas and frequently used features.

4. Implementing Continuous Integration/Continuous Deployment (CI/CD)

Integrate automated testing into CI/CD pipelines to facilitate frequent and automated deployments of software updates. Automate the execution of tests triggered by code commits or builds, ensuring that new changes are thoroughly tested before deployment.

5. Establishing Robust Monitoring and Reporting Mechanisms

Implement monitoring tools to track automated test execution results and identify any issues or failures promptly. Generate comprehensive test reports to provide visibility into the testing process and facilitate data-driven decision-making.

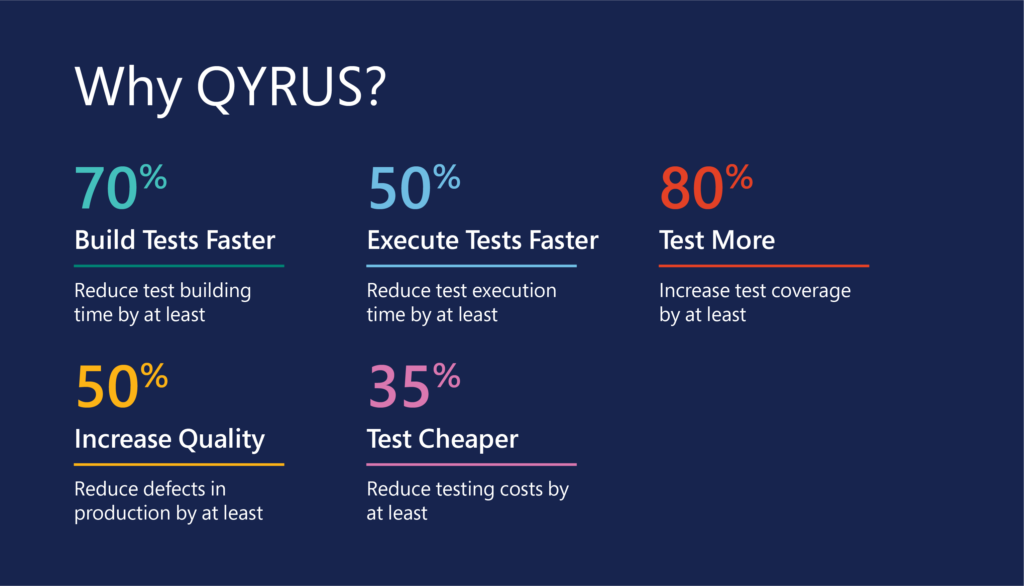

Quinnox's Qyrus Platform: Empowering Banks with Automated Testing Excellence

Qyrus is an on-demand AI-powered SaaS automated software testing platform that deploys machine learning algorithms, an intuitive user experience, and a collaborative codeless approach to test automation.

With Qyrus automated testing platform, banks can:

- Automate end-to-end testing processes, including functional, regression, and performance testing.

- Ensure compliance with industry regulations through built-in validation checks and reporting capabilities.

- Enhance software security by conducting thorough security audits and vulnerability assessments.

Read how Qyrus’s automation capabilities helped Monument Bank Limited, UK-based neo bank shorten testing cycles and boost output, helping the bank increase its commercial success.

Final Thoughts

As the banking industry navigates the complexities of digital transformation, the role of automated testing in revolutionizing software quality stands out as a beacon of innovation and efficiency. By embracing automation, banks can deliver seamless user experiences, and uphold the integrity of their software solutions in an ever-evolving industry landscape.

Furthermore, AI-driven test automation will also facilitate greater collaboration between traditional banks, fintech startups, and open bank platforms, encouraging innovation, collaboration, security, and customer-centric banking experiences.

Ready to revolutionize your testing process? Reach Quinnox today!