Accelerate IT operations with AI-driven Automation

Automation in IT operations enable agility, resilience, and operational excellence, paving the way for organizations to adapt swiftly to changing environments, deliver superior services, and achieve sustainable success in today's dynamic digital landscape.

Driving Innovation with Next-gen Application Management

Next-generation application management fueled by AIOps is revolutionizing how organizations monitor performance, modernize applications, and manage the entire application lifecycle.

AI-powered Analytics: Transforming Data into Actionable Insights

AIOps and analytics foster a culture of continuous improvement by providing organizations with actionable intelligence to optimize workflows, enhance service quality, and align IT operations with business goals.

Managing cloud expenses has become one of the most pressing challenges for organizations undergoing digital transformation. According to Flexera’s 2024 State of the Cloud report, nearly 84% of enterprises identified managing cloud spend as their top cloud challenge—surpassing concerns like security or compliance. A major contributor to this problem is over-provisioning: companies often purchase more compute, storage, or networking resources than necessary, leading to underutilized assets that continue to accrue costs invisibly.

Without a centralized framework for governance, it’s common for organizations to face “cloud sprawl”—an accumulation of unused or forgotten instances, databases, and services that quietly drive-up costs. According to a survey by Everest Group found that 67% of organizations experienced higher-than-expected cloud costs, with 82% of global organizations reporting that at least 10% of their cloud spend is wasted.

At its core, FinOps is not just about cutting costs—it’s about aligning cloud spending with business value. It brings together finance, engineering, and product teams under a shared responsibility model, promoting real-time visibility, cost accountability, and informed decision-making. With the implementation of right FinOps best practices, organizations gain the ability to analyze cloud costs in near real time, attribute them to specific teams or projects, and implement governance measures like budget alerts and usage guardrails.

In this blog, let us dive deep into ten FinOps best practices that organizations can implement to enhance their cloud financial management strategies.

What Is FinOps?

FinOps—short for Financial Operations, or more formally, Cloud Financial Management—is a cultural practice and a set of processes that bring together finance, technology, and business teams to collaborate on cloud financial management.

By fostering a shared responsibility model between engineering, finance, and business teams, FinOps creates a unified approach to controlling cloud spend. For example, through real-time cost tracking and forecasting tools, teams can access granular data about who is spending what, when, and why—enabling better decision-making and budget adherence. Furthermore, structured governance in FinOps, such as setting budget thresholds and defining financial KPIs, empowers organizations to pre-empt overspending and improve cloud ROI.

How FinOps Works

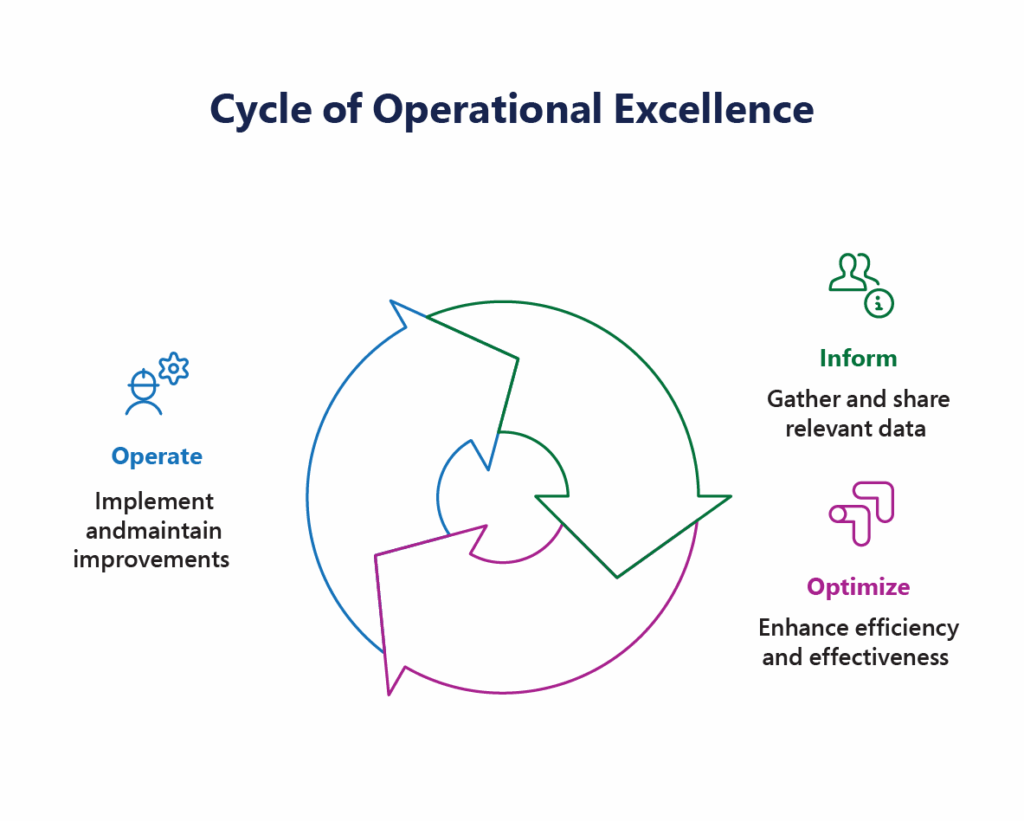

At its core, FinOps operates as a dynamic framework that bridges the gap between finance, technology, and business teams to optimize cloud spending. It transforms what was once a fragmented and opaque process into a transparent, collaborative, and iterative practice. The fundamental mechanism of FinOps revolves around three key phases: inform, optimize, and operate.

- Inform: This phase ensures that all stakeholders—from engineers to executives—have real-time access to detailed, actionable data about cloud usage and costs. By leveraging sophisticated cloud cost management platforms and tagging strategies, teams gain clarity into where and how cloud resources are being consumed. This transparency is crucial for making informed decisions rather than reacting to bills after the fact.

- Optimize: With insights in hand, FinOps teams actively identify inefficiencies such as idle resources, over-provisioned instances, or underutilized services. Optimization involves setting budgets, automating resource management, and adopting cost-saving measures like reserved instances or savings plans. Crucially, this phase requires ongoing experimentation and collaboration to balance cost with performance and innovation needs.

- Operate: FinOps embeds financial accountability into everyday workflows. This means integrating cost awareness into deployment pipelines, engineering sprints, and business planning. Teams share responsibility for cloud costs through mechanisms like showback/chargeback and continuous education, fostering a culture where financial stewardship is a shared value, not just a finance department mandate.

Also Read: Is Your Business Ready to Drive Digital Agility with Cloud Transformation Services?

Top 10 FinOps Best Practices to Adopt in 2025

The evolving cloud landscape demands agility, collaboration, and a continuous feedback loop to stay ahead of cost overruns and maximize ROI. With that foundation in place, let’s explore ten actionable FinOps best practices that will help your organization gain control, drive efficiency, and align cloud spending tightly with your strategic goals in 2025.

1. Align Cloud Spend with Business Goals

Financial efficiency starts with strategic alignment. Cloud spending must be tightly coupled with business objectives, whether that means accelerating product development, enhancing customer experience, or scaling infrastructure for global reach. By mapping cloud budgets directly to key performance indicators (KPIs), organizations can prioritize investments that yield the highest business impact.

Leading enterprises embed FinOps into their strategic planning cycles, ensuring that finance leaders understand how cloud costs translate into revenue, market share, or operational excellence. For example, Gartner’s 2023 forecast highlights that organizations aligning cloud expenses with business outcomes outperform peers in cost control and agility.

2. Establish a Cross-Functional FinOps Team

FinOps thrives on collaboration. Isolating cloud finance management within a single department impedes agility and accountability. The ideal FinOps team spans finance, cloud engineering, procurement, and product management, enabling rapid decision-making and shared ownership of cloud costs.

This cross-pollination promotes a balanced perspective where technical feasibility meets financial discipline. Organizations with integrated FinOps teams reduce cost overruns while improving productivity as teams are empowered to act swiftly and knowledgeably.

3. Enable Real-Time Cloud Cost Visibility

The era of monthly or quarterly cost reports is obsolete. Real-time, granular visibility into cloud spend empowers teams to respond immediately to cost anomalies and usage inefficiencies. This requires integrating cloud cost management platforms directly with cloud service providers and internal dashboards.

4. Implement Showback and Chargeback Models

Transparency alone is insufficient without mechanisms that promote accountability. Showback and chargeback models provide financial feedback loops by either displaying cloud costs to teams (showback) or billing teams based on their consumption (chargeback).

These models incentivize teams to optimize resource usage and align with organizational budgets. While chargeback may be complex to implement, it often leads to greater cost ownership.

5. Automate Cost Optimization

Manual cost management is unsustainable at scale. Automation leveraging AI-driven tools to identify idle resources, right-size instances, and optimize storage tiers—enables continuous cloud cost control without burdening teams.

That’s not all! Automation also supports dynamic scaling aligned with workload demands, ensuring resources are not over-provisioned. Cloud-native providers now offer automated recommendations, and independent platforms enhance these capabilities. Organizations using automation reduce cloud expenses by an average of 20%, as revealed in a recent Cloud Efficiency Report.

6. Set Budget Alerts and Guardrails

Proactive financial governance requires setting budget thresholds and automated alerts. These guardrails prevent cost overruns before they spiral out of control and facilitate rapid corrective actions.

Budgets should be granular—covering teams, projects, and environments—and integrated with workflow systems for immediate notification. According to a 2024 FinOps maturity benchmark, companies with proactive budget controls experience 35% fewer unexpected cloud cost incidents.

7. Use Reserved Instances and Savings Plans Effectively

Cloud providers offer Reserved Instances (RIs) and Savings Plans as mechanisms to reduce costs for predictable workloads. However, optimizing their use requires careful analysis of workload patterns, contract terms, and renewal strategies.

Organizations that master this balance can achieve up to 60% savings on compute costs. Leading FinOps teams leverage predictive analytics to dynamically purchase and adjust reserved capacity, avoiding both underutilization and overspending.

8. Conduct Regular Cloud Spend Audits

Routine audits are essential to uncover inefficiencies, detect anomalies, and validate financial controls. These audits examine resource utilization, billing accuracy, contract compliance, and tagging consistency.

Regular audits—quarterly or biannually—provide data to refine policies and improve cost allocation accuracy. As per a recent Cloud Risk Report, regular financial audits reduce fraud risk and billing errors by 30%.

9. Educate Teams on FinOps Culture

FinOps success depends heavily on culture. Training teams on cloud economics, cost optimization strategies, and the rationale behind spending decisions fosters collective ownership.

Workshops, certifications, and gamification help embed financial accountability into everyday workflows. The FinOps Foundation highlights that companies investing in FinOps education report drive 50% higher engagement in cost-saving initiatives.

10. Benchmark and Continuously Improve

Continuous benchmarking against industry peers, internal historical data, and evolving cloud pricing model is crucial. Regularly revisiting KPIs and performance metrics ensures FinOps practices evolve in tandem with technological and business changes.

Data-driven retrospectives and iterative process improvements transform FinOps from a cost center into a strategic enabler of cloud innovation.

Also Read: 5 Benefits of Cloud Cost Optimization Through Automation

Overcoming Common Challenges in FinOps Implementation

Aspect |

Traditional Testing |

Chaos Engineering |

| Primary Goal | Validate functional correctness of code and features | Validate system resilience under unpredictable and adverse conditions |

| Environment | Mostly runs in development or staging environments | Often runs in production or production-like environments (with safeguards) |

| Scope of Failures | Tests known scenarios like missing inputs, invalid formats | Tests unknown unknowns like service failures, latency spikes, and node crashes |

| Failure Type Simulated | Code-level bugs, unit test failures, API contract violations | Real-world incidents: disk failure, API timeout, network partition, traffic surge |

| Testing Philosophy | Assumes the environment is stable and controlled | Assumes that failures are inevitable and should be proactively tested |

| Experimentation Model | Static test cases with predefined inputs/outputs | Hypothesis-driven experiments with observable impact on system behavior |

| Blast Radius | No concept of blast radius | Introduces concept of blast radius to control experiment impact |

| Observability Need | Moderate observability — logs and some basic metrics | Heavy reliance on observability — metrics, traces, alerts are crucial |

| Metrics Focus | Focuses on test pass/fail criteria | Focuses on latency, error rates, throughput, availability, UX impact |

| Change Trigger | Runs automatically during builds or deployments | Triggered as controlled, planned experiments by SRE or DevOps teams |

| Risk Coverage | Covers expected failures | Covers unexpected, cascading, systemic failures |

| Business Impact | Validates business rules and feature compliance | Protects customer experience and SLAs under failure conditions |

| Feedback Loop | Feedback mostly confined to QA cycles | Feedback drives resilience engineering, architecture, and runbooks |

| End Goal | Ensure code quality | Ensure system reliability and operational readiness |

Adopting FinOps best practices isn’t a one-time initiative—it’s a transformational journey, especially for large and complex organizations. Understanding key roadblocks and proactively addressing them is critical to unlocking the full potential of cloud financial management.

1. Siloed Teams

The Challenge:

Departments like finance, IT, and product often operate in isolation, each pursuing their own goals. This disconnect hampers visibility into how decisions impact overall cloud spend. For instance, IT may design architectures without understanding their financial impact, while finance may lack insight into technical drivers.

The Fix:

Establish cross-functional FinOps teams comprising members from IT, finance, engineering, and product. Align them on shared KPIs and business goals. Foster collaboration through regular syncs, shared dashboards, and open communication. This collective ownership helps eliminate blind spots and promotes smarter cloud decisions.

2. Limited Cost Visibility

The Challenge:

Without real-time and centralized visibility, cloud cost management becomes reactive. Disparate tracking methods and lack of standardized tagging make it difficult to trace expenses back to teams, projects, or workloads—leading to overspend and inefficiency.

The Fix:

Invest in unified cloud cost monitoring tools that provide granular, real-time insights. Implement standardized tagging across all cloud assets and enforce it through policies and automation. Conduct regular audits to identify anomalies, underutilized resources, and ensure accurate cost attribution.

3. Resistance to Change

The Challenge:

Implementing FinOps often requires shifting long-standing habits and mindsets. Teams comfortable with legacy processes may resist adopting new tools, metrics, or collaborative workflows—slowing down FinOps adoption.

The Fix:

Drive change through education and engagement. Conduct workshops, share success stories, and highlight early wins to display impact. Empower teams with the right tools and training. Leadership should actively sponsor the transition, reinforcing a culture of shared accountability and continuous improvement.

Ready to take control of your cloud spend?

Elevate Your FinOps Strategy with Qinfinite

Successfully implementing FinOps best practices and achieving sustainable ROI demands more than just good intent—it requires an intelligent, adaptive platform. Qinfinite, our AI-powered intelligent application management platform, delivers advanced capabilities purpose-built to support every phase of the FinOps lifecycle with:

- Unified Visibility and Reporting – Qinfinite offers a 360° real-time view of multi-cloud usage, spend, and allocation—powered by dynamic tagging, anomaly detection, and intelligent cost signals. This visibility helps you identify cost drivers, track efficiency across teams, and make proactive, data-driven decisions.

- AI-led Cost Optimization and Rightsizing – Qinfinite leverages machine learning to recommend and auto-execute rightsizing actions, shut down idle resources, and continuously optimize workloads. It turns cost optimization from a manual effort into an autonomous process.

- Centralized FinOps Governance – With Qinfinite, you can enforce policies across teams, projects, and environments using rule-based governance frameworks and integration with IAM tools. This ensures every team operates within budget while aligning with strategic business goals.

- Automation and Intelligent Scheduling– By using Qinfinite’s self-healing automations and scheduling bots to control non-production environments, you can avoid cloud waste.

- Continuous Architecture & Spend Reviews – Qinfinite facilitates automated well-architected reviews, correlating performance, resilience, and cost data. These insights help teams align architecture decisions with FinOps principles and long-term efficiency goals.

- AI-Driven Insights and Sustainability Metrics – Stay ahead of FinOps trends with agentic AI that not only forecasts spend but drives autonomous remediation. Qinfinite also tracks sustainability indicators—helping you reduce both cloud costs and carbon footprint while remaining compliant and competitive.

Final Thought

The data is clear—organizations are losing millions annually to cloud waste, inefficiencies, and a lack of financial governance. But, this isn’t just a cost issue; it’s a strategic one. FinOps offers a way forward not as a quick fix but as a long-term operating model, that brings financial discipline into the heart of cloud operations.

Whether you’re just starting out or refining a mature FinOps practice, now is the time to level up your approach. Because smarter cloud financial management doesn’t just start here—it scales from here.

FAQs Related to FinOps Best Practices

FinOps is all about managing cloud costs in a smart and collaborative way. It’s a mix of finance, operations, and technology teams working together to ensure that cloud spending is optimized and aligned with business goals.

FinOps is important because cloud services can be complex and often lead to unexpected costs. Without proper management, companies can easily overspend or fail to optimize their cloud usage. By adopting FinOps, organizations can gain better visibility into their cloud expenses, make more informed decisions, and ultimately drive more value from their cloud investments while controlling costs.

FinOps best practices enhance cloud financial management by improving visibility, accountability, and collaboration across teams. By bringing together finance, engineering, and operations, FinOps creates a shared understanding of cloud costs and usage. This ensures everyone is on the same page when it comes to making decisions about cloud resources.

Absolutely! One of the key benefits of FinOps is that it helps businesses spot waste, like unused resources or over-provisioned services. By taking action to clean up and optimize workloads, FinOps can significantly reduce unnecessary cloud costs.

The best way to start is by creating a FinOps team that includes people from finance, tech, and operations. Once you have your team, set clear goals and key performance indicators (KPIs) to track progress. And, don’t forget to use real-time cost monitoring tools to keep an eye on cloud expenses and make adjustments as needed.