According to a recent Forrester study, a whopping 84% of insurance customer experience professionals prioritize CX improvement today, compared to just 63% in 2019. Customer experience (CX) is no longer an “optional extra” for insurance companies – it’s the engine driving growth and loyalty in 2024.

Why the sudden shift? Customers today demand a smooth, personalized, and frictionless experience across every touchpoint. Failing to deliver seamless customer experience results in loss of customer loyalty and ultimately revenue opportunities.

But delivering exceptional CX isn’t always easy. Legacy systems, complex processes, and siloed data often restrict insurance firms in delivering personalized interactions that meet customer expectations.

So, how can insurers navigate these challenges to enhance customer experience that brings repeat business and attracts new clients? In this blog, we will explore the top 5 trends in customer experience for insurance, focusing on innovations that go beyond the conventional realms of chatbots and voice technology and boost customer satisfaction, reduce costs, and unlock new revenue streams.

1. Personalized Insurance Apps: Revolutionizing Access and Engagement

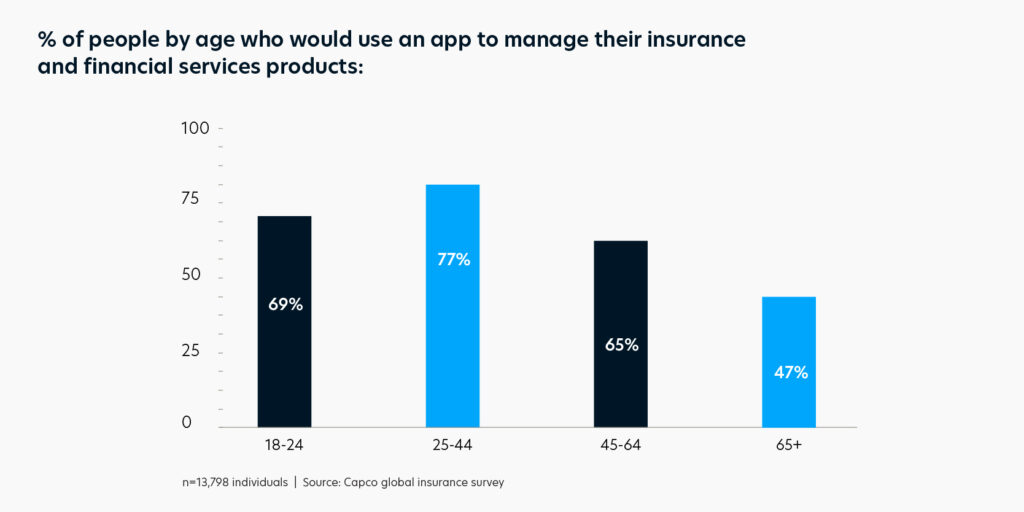

Personalized insurance apps are becoming the cornerstone of customer experience in 2024. Insurers are leveraging advanced analytics and artificial intelligence to tailor applications to individual needs, providing customers with real-time insights into their coverage, premiums, and claims. This trend not only enhances customer satisfaction but also boosts customer retention rates, as clients feel more in control of their insurance journey.

According to a recent study, when providing personalized services, insurers saw an 81% increase in customer retention and an 89% increase in customer engagement.

Source: Capco Global Insurance Survey

2. Rise of Insurtech: Transforming Traditional Models

The insurtech revolution is in full swing, reshaping the insurance landscape and redefining customer expectations. Insurtech companies are leveraging technology to streamline processes, reduce costs, and deliver a more personalized experience.

Insurers are partnering with insurtech firms to integrate disruptive technologies such as blockchain for secure transactions, IoT for risk monitoring, and AI for predictive analytics. The most important insurance operations, such as underwriting, fraud prevention, claims processing, etc., are addressed by these solutions.

For example, Hippo uses AI for claims processing, reducing average settlement times from weeks to days

3. Customer-Centered Design: Shaping the Future of Insurance Products

As customers demand more intuitive and user-friendly experiences, insurance companies are embracing customer-centered design principles. This approach involves understanding the customer’s journey, pain points, and preferences to create products that truly meet their needs. By incorporating design thinking, insurers are developing policies that are easy to understand, transparent, and tailored to individual lifestyles.

John Deere Financial, a leading provider of agricultural equipment financing, implemented a customer-centric design approach, resulting in a 20% increase in website conversion rates and a 40% reduction in call center calls.

4. Simplicity and Speed Improve Customer CX: Removing Friction from Processes

In an era dominated by instant gratification, simplicity, and speed have become the cornerstones of a positive customer experience. Insurance companies recognize the need to streamline their processes, reduce bureaucratic hurdles, and provide swift solutions to customer queries and claims.

According to a study by PwC, 76% of insurance customers expect insurers to use new technologies to simplify processes. This expectation is driving insurers to adopt automation, digitization, and self-service options to enhance the efficiency of their operations.

Progressive Insurance stands out as an industry leader in simplifying and expediting customer interactions. Their Snapshot program, which utilizes telematics to monitor driving habits, not only personalizes insurance rates but also simplifies the claims process. With features like mobile claim filing and virtual assistance, Progressive prioritizes simplicity and speed, ensuring that customers can navigate the insurance landscape with ease.

5. Data-Driven Decision Making: Leveraging Insights for Continuous Improvement

In the age of big data, insurance companies recognize the power of data-driven decision-making to enhance customer experience. By leveraging data analytics, insurers gain valuable insights into customer behavior, preferences, and pain points.

AXA, a global insurance giant, exemplifies the transformative potential of data-driven decision-making. By analyzing customer data, AXA identifies trends, predicts future needs, and tailors products and services accordingly. This not only positions AXA as a forward-thinking insurer but also ensures that its offerings remain relevant and responsive to the ever-changing demands of its customer base.

Looking Ahead

The insurance industry is at a crossroads. The days of static policies and impersonal interactions are fading fast, replaced by a rising tide of customer-centricity driven by emerging trends. From hyper-personalization to AI-powered efficiency, embracing these trends isn’t just an option, it’s the key to unlocking CX excellence and leaving your competitors in dust.

Imagine a world where customers no longer dread insurance interactions, policies that seamlessly adapt to their needs, claims settled with the click of a button, and support available anytime, anywhere. This is the future of insurance CX, and it’s within your reach.

Don’t be a spectator in this CX revolution. But where to begin? Quinnox is here to help you implement these trends, overcome challenges, and achieve CX excellence. Together, we can rewrite the insurance experience, one satisfied customer at a time.

Connect with our Experts Today!

Explore more on elevating your customer experience journey!