A recent McKinsey report revealed that companies prioritizing CX outperform their peers by 80% in profitability. Customer experience (CX) is no longer a mere buzzword; it’s the cornerstone of sustainable profitability. But understanding and optimizing CX requires data-driven insights, and who would be better to champion this initiative than the CFOs?

CFOs, traditionally masters of financial metrics, now hold a unique vantage point. They bridge the gap between finance and operational data, offering a holistic view of the customer’s journey. Yet, many CFOs still see CX as a “soft” metric, struggling to connect it with tangible financial benefits. This is where data analytics comes in.

The Power of Data:

According to a recent survey by Gartner, 64% of CFOs consider data analytics to be crucial for achieving their business objectives. By leveraging the insights within customer data, CFOs can transform CX from a subjective concept into a strategic driver of profitability.

However, CFOs face several challenges when it comes to prioritizing and implementing strategies to enhance customer experience as listed below:

- One of the primary obstacles is the traditional role of CFOs as guardians of financial resources, often leading them to overlook the potential of data analytics in influencing customer interactions.

- Additionally, the lack of alignment between financial goals and customer-centric objectives poses a significant challenge.

- CFOs must navigate through siloed organizational structures that hinder effective collaboration between finance and other departments, such as marketing and customer service.

- Moreover, the sheer volume and complexity of data available can overwhelm CFOs, making it difficult to extract meaningful insights that can drive customer-centric decisions.

- Legacy systems and outdated technologies further compound the problem, inhibiting the agility required for real-time analytics and responsive customer interactions.

These challenges collectively hamper the ability of CFOs to leverage data analytics effectively in enhancing customer experience. But here is what CFOs can do to harness data analytics efficiently to drive CX transformation:

1. Aligning Financial Goals with Customer-Centric Objectives:

CFOs need to recognize the symbiotic relationship between financial success and customer experience. By aligning financial goals with customer-centric objectives, CFOs can create a shared vision that permeates throughout the organization. This alignment ensures that financial decisions consider the impact on customer satisfaction, thereby fostering a culture where both financial and customer-centric goals are pursued simultaneously.

2. Breaking Down Organizational Silos:

Siloed structures can hinder collaboration and information flow between departments. CFOs should actively promote cross-functional teams that bring together finance, marketing, customer service, and IT. This collaboration enables a holistic understanding of customer data, breaking down silos and fostering an environment where insights can be shared seamlessly. CFOs can play a pivotal role in facilitating communication and ensuring that financial decisions align with the broader customer experience strategy.

3. Investing in Advanced Analytics and Technology:

To effectively harness data analytics, CFOs must invest in advanced analytics tools and technologies. Upgrading from legacy systems to modern, integrated platforms enables real-time data analysis, allowing organizations to respond swiftly to changing customer needs. Machine learning algorithms can uncover patterns and trends within the data, providing actionable insights for CFOs to make informed decisions that positively impact customer experience.

4. Quantify the ROI of CX Investments:

CFOs should redefine key performance indicators (KPIs) to include customer-centric metrics. By going beyond traditional financial metrics, such as revenue and profit, CFOs can incorporate customer satisfaction scores, Net Promoter Scores (NPS), and customer lifetime value into their analysis. This shift in focus ensures that financial decisions are evaluated based on their potential impact on customer relationships and long-term loyalty.

5. Fostering a Data-Driven Culture:

Cultivating a data-driven culture is essential for the successful implementation of data analytics strategies. CFOs can lead by example, emphasizing the importance of data in decision-making processes. Training programs and workshops can be organized to enhance the data literacy of employees across departments, enabling them to leverage analytics tools effectively. A data-driven culture empowers employees at all levels to contribute to the continuous improvement of customer experience.

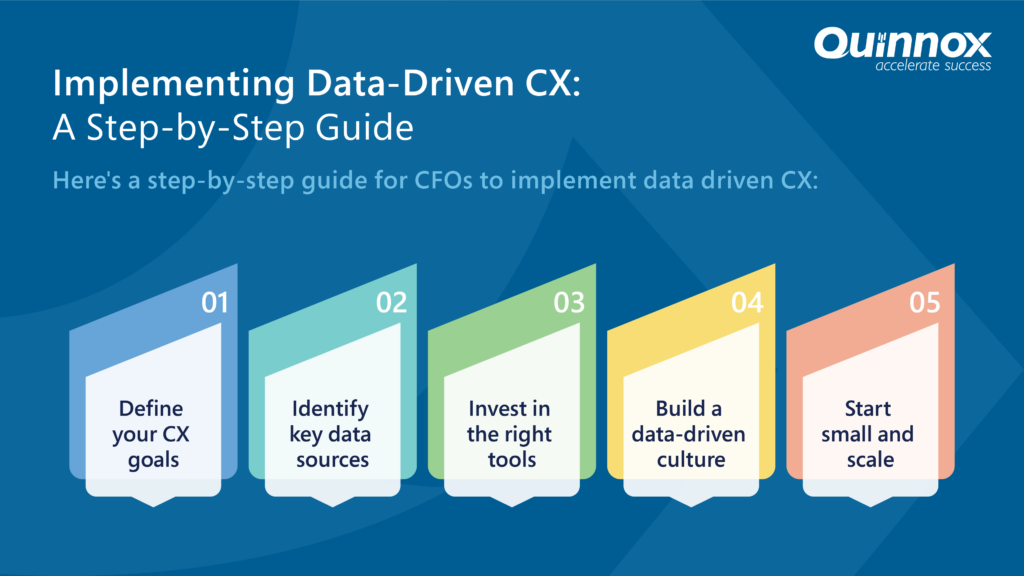

Implementing Data-Driven CX: A Step-by-Step Guide:

Here’s a step-by-step guide for CFOs to implement data driven CX:

- Define your CX goals: Clearly define your desired outcomes, such as increased customer satisfaction, reduced churn, or improved brand loyalty.

- Identify key data sources: Determine the data sources that will help you measure progress towards your goals. This could include customer feedback, transaction data, website analytics, and social media data.

- Invest in the right tools: Choose data analytics platforms that are user-friendly and offer the functionalities you need to analyze and interpret your data effectively.

- Build a data-driven culture: Encourage a culture of data-driven decision-making within the finance team and across the organization.

- Start small and scale: Begin by focusing on a few key areas for improvement and gradually expand your data driven CX initiatives as you gain confidence and success.

Quick Insight: Companies with superior CX deliver up to 3 times the financial performance of their competitors.

The Final Equation:

Data analytics is not just for marketing or customer service teams; it’s a powerful tool for CFOs to drive profitability through enhanced customer experience. By strategically using data analytics, CFOs can move beyond traditional financial roles and become champions of customer experience. By embracing data analytics, CFOs can transform CX from a cost center to a profit driver.

Armed with actionable insights, they can create personalized experiences that improve customer satisfaction, reduce churn, and attract high-value customers. This ultimately translates to increased revenue, reduced costs, and sustainable profitability. Remember, in today’s data-driven world, prioritizing CX isn’t an expense – it’s an investment in the future of your business. So, CFOs, the time to leverage data analytics for enhanced CX is now. The reward? A loyal customer base and a flourishing bottom line.

Is your company developing a comprehensive CX transformation roadmap aligned with your financial goals? If so, Quinnox can be your trusted partner in data driven CX Transformation. Together, we can unlock the true potential of data analytics to create customer-centric experiences that drive sustainable profitability and growth.

Connect with our Experts Today!

Explore more on elevating your customer experience journey!