According to a BCG study, companies that effectively manage their digital transformations achieve a remarkable 1.8 times the average return on investment compared to those with less effective management.

In the fast-paced global business landscape, digital transformation is no longer a luxury, but a necessity for companies to thrive. As we look toward 2024, the role of Chief Financial Officers (CFOs) becomes increasingly pivotal in steering organizations through this era of change.

Today’s CFOs have no choice but to plan their company’s transition toward an increasingly digital landscape and stay at the forefront of understanding how new technologies can improve efficiency, customer service, and productivity.

The paradigm shift propelled by emerging technologies like artificial intelligence, machine learning, and blockchain is transforming industries and revolutionizing business processes. For CFOs, this means navigating financial complexities while spearheading digital initiatives that drive efficiency, customer service, and productivity gains.

In this blog, we’ll explore how CFOs can not only navigate but redefine the future of finance through strategic adoption of digital transformation trends.

1. Cloud Computing: Transforming Infrastructure and Redefining Costs

The cloud is no longer a buzzword; it’s a fundamental enabler of digital transformation. Cloud-based financial management systems provide real-time access to financial data, streamlining budget management and reducing the risk of errors. These systems also enhance collaboration, allowing finance teams to work seamlessly across geographies, improving efficiency and reducing costs.

According to Gartner, by 2025, 80% of enterprises will have shut down their traditional data centers. CFOs must strategically evaluate the cost implications of migrating to the cloud, considering factors such as subscription models, data transfer costs, and potential savings in hardware maintenance.

2. Big Data Analytics: Turning Data into Financial Insights

The era of big data is here, and organizations are leveraging analytics to derive meaningful insights that drive decision-making. According to a survey by Deloitte, 77% of organizations consider big data analytics a critical priority. CFOs need to assess the investment in analytics tools against the potential gains in operational efficiency and strategic decision-making.

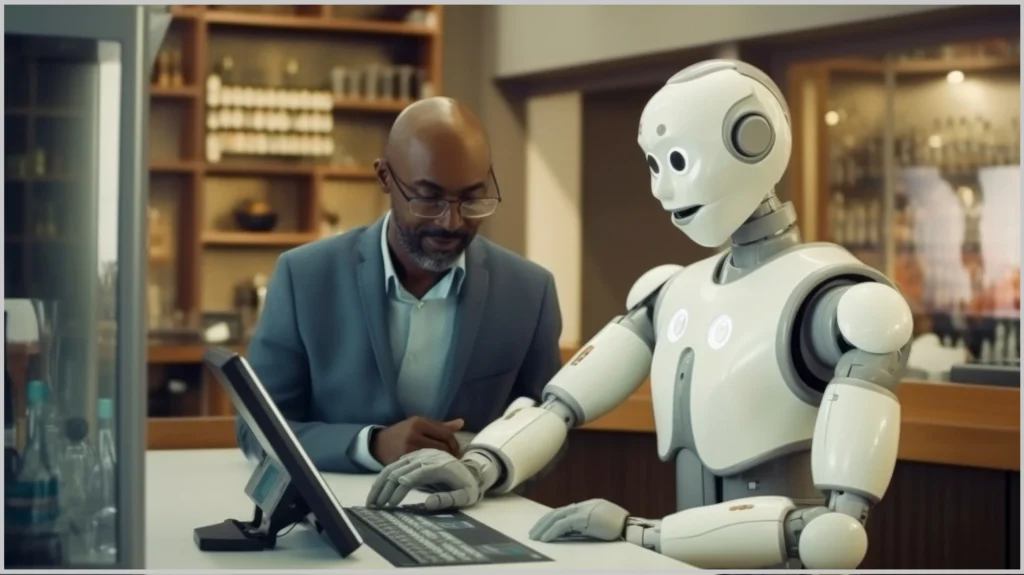

3.Artificial Intelligence (AI) and Machine Learning (ML): Enhancing Financial Processes

AI and ML technologies are increasingly being integrated into financial processes, from automating routine tasks to predicting market trends. A McKinsey report estimates that AI and automation could add $13 trillion to global economic activity by 2030. CFOs need to weigh the upfront costs of implementing AI against the long-term benefits of enhanced efficiency and accuracy.

4. Cybersecurity: Safeguarding Finances in the Digital Age

With the increasing reliance on digital platforms, the importance of cybersecurity cannot be overstated. Prioritizing cybersecurity to protect sensitive financial data, and implementing robust cybersecurity measures, such as multi-factor authentication, encryption, and regular security audits, is essential. CFOs must collaborate with their IT counterparts to ensure the resilience of financial systems against cyber threats, safeguarding both the company’s assets and its reputation.

For instance, Equifax’s data breach fallout serves as a cautionary tale for CFOs navigating the digital landscape. The breach exposed sensitive personal information of 147 million people, leading to numerous lawsuits, regulatory fines, and a significant drop in Equifax’s stock price.

The financial fallout from the data breach highlighted the importance of robust cybersecurity measures and the need for CFOs to actively manage risks associated with digital transformation initiatives.

5. Blockchain: Transparent Financial Transactions

Blockchain, known for its role in cryptocurrencies, has broader applications in streamlining financial transactions and ensuring transparency, security, and traceability. CFOs can leverage blockchain to streamline processes like auditing, invoicing, and payment transactions. This not only reduces the risk of fraud but also enhances trust among stakeholders. As CFOs prioritize transparency, blockchain becomes a powerful tool for maintaining the integrity of financial data.

For Instance, imagine a global supply chain where multiple parties are involved in transactions, from manufacturers to distributors and retailers. Using blockchain, every transaction is recorded in a decentralized ledger that is visible to all authorized participants. This transparency reduces the risk of fraud and ensures that financial transactions are traceable and verifiable.

6. Robotic Process Automation (RPA): Streamlining Operational Efficiency

Automation is key to achieving operational efficiency, and RPA is a game-changer for CFOs. A study by McKinsey found that RPA can lead to a 20-25% increase in the productivity of finance professionals. Repetitive, rule-based tasks such as data entry, invoice processing, and reconciliation can be automated, freeing up valuable human resources for strategic financial planning. By embracing RPA, CFOs can optimize workflows, minimize errors, and reduce costs, ultimately maximizing ROI.

7. Customer-Centric Financial Strategies: Personalized Services

Digital transformation is not just about internal processes; it’s also about meeting customer expectations. CFOs should adopt customer-centric financial strategies, leveraging data to understand customer behavior, preferences, and feedback. By aligning financial decisions with customer needs, CFOs can drive revenue growth, enhance customer experience, and ultimately maximize the return on their digital investments.

Paving the Way for Financial Excellence in 2024

“Change is inevitable. Growth is optional”

– John Maxwell

The challenges faced by CFOs in the pursuit of digital transformation are undeniably formidable, but armed with the right technologies, they can not only navigate these challenges but emerge stronger and more resilient. The trends outlined in this blog are not just tools; they are beacons guiding CFOs towards a future where financial excellence isn’t a goal but a reality.

As we march into 2024, the question isn’t whether CFOs can overcome these challenges—it’s how far these transformative trends will take them on the journey to unparalleled financial success. By strategically assessing the financial implications of adopting digital transformation tech trends, CFOs can guide their organizations toward maximizing ROI and sustaining long-term financial health.

Do you merely want digital transformation, or are you truly interested in reshaping the future of finance?

Quinnox stands as your trusted partner in this transformative journey. Our expertise aligns seamlessly with the trends delineated, offering not just solutions but a roadmap to financial innovation. Together, let’s turn challenges into triumphs and chart a course toward a digitally transformed financial future.