A recent study by PwC concluded that 86% of customers considered leaving their bank if it failed to meet their needs.

With customers having a vast range of options to choose from, the banking sector is under immense pressure to offer customers something better than their competitors can’t. Therefore, it has become imperative for banks to provide quality customer services that help reduce complaints, deliver personalized experiences, increase business and, most importantly, improve overall customer experience. But what does customer experience (CX) mean? Simply put, it is how customers feel about a bank and its services. It’s more like how well banking institutions live up to the promises made and the expectations raised while promoting their offerings. So, if you want to build brand loyalty and win customers’ trust and retain them for a long then improving your CX should be the top priority. However, before you jump-start your strategies to deliver high-quality CX, have a look at the five customer experience trends in banking that will reshape your plan of action in the coming days:

- More and More Digitalization of Financial Services to Continue

According to a Boston Consulting Group study, 43% of customers would leave their bank if it failed to provide an excellent digital experience. This is not surprising, given that customers now expect the same level of convenience and customer service from their bank as they do from other online retailers.

A seamless digital payment experience has many benefits for both banks and customers. For banks, it can lead to increased customer satisfaction and loyalty and higher profits. BCG’s study found that banks that excel at providing a seamless digital experience generate 10% more revenue than their peers.

2. Increasing Collaboration with Fintech Companies

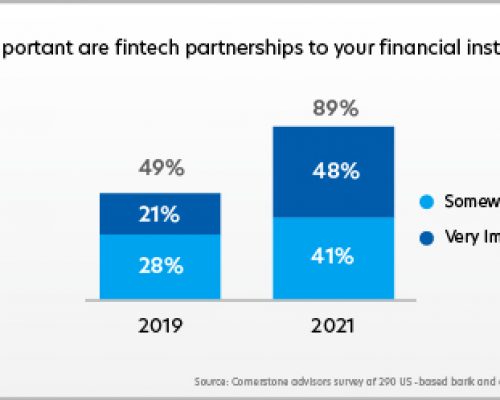

Bank-fintech partnerships are slowly gaining momentum and are definitely becoming the hot topic of discussion in bank boardroom meetings. According to The State of the Union in Bank-Fintech Partnerships report from Cornerstone Advisors, nearly nine in 10 financial institutions consider fintech partnerships significant to their business. Bank-Fintech collaborations are up from 49% in 2019 to 89% in 2021, as shown in the image below:

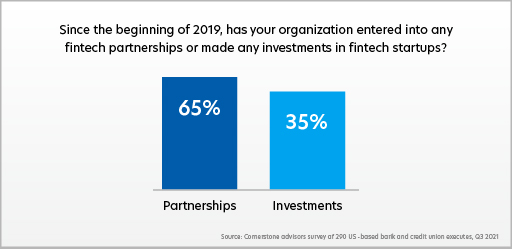

The Cornerstone Advisor report found that overall, about 65% of bank and credit unions partnered with at least one fintech firm in the last three years, whereas 35% invested in startups in the fintech space.

There are a few different ways that banks can collaborate with fintech. Banks can either invest in fintech companies or partner with them on specific projects to take advantage of fintech’s expertise without making a long-term commitment. For instance, Banking Circle, a fully licensed payments bank, collaborated with SIA, a leading European fintech company, to offer instant payments services and infrastructure across Europe. Even popular banks like American Express partnered with digital card platform i2c to strengthen their presence in the fintech space, which will allow Amex to make its card benefits and perks available to different startups via its network.

3. Focus on Hyper Personalization

In simple terms, hyper personalization refers to the consumer-centered approach in delivering digital banking services leveraging behavioural data science and Artificial Intelligence (AI) to generate real-time data on consumer insights and accordingly offer themrelatable products and services they need. According to McKinsey, banking personalization can help banks reduce acquisition costs by as much as 50%, increase revenues by 5 to 15%, and boost the efficiency of marketing spend by 10 to 30%.

Hyper personalization is popular among financial institutions such as the Bank of Ireland who is intending to become the ‘Netflix of Banking’ by utilizing data science, analytics, AI and ML to make the right recommendations to its customers based on what is happening in their respective lives.

4. Integration of AI and Data Analytics in Banking Services

Needless to say, emerging technologies like AI, ML, data analytics, Power BI and more are integral to how consumers interact with their financial and banking institutions. These evolving technologies are helping banks personalize customer experiences, better targeting and profiling, quick risk assessment, and credit profiling, to name a few. According to the latest market report, the global usage of AI in banking is estimated to reach $64.03 billion by 2030, making it one of the in-demand technological integration for the industry.

Banks collect data from various sources, including customer transactions, account activities, and credit reports. This data provides valuable insights into customer behavior and can be used to develop targeted marketing campaigns, improve product offerings, and much more with the integration of AI-powered analytics. For example, by using AI-powered chatbots, many banks can provide 24/7 customer support with minimal human intervention.

5. Making Green Finance a Priority

As sustainability becomes an increasingly important issue for consumers, it’s more important than ever for banks to consider making green finance a priority. Not only is it a great way to appeal to eco-conscious customers, but it’s also a way for banks to show that they are responsible corporate citizens who care about our planet’s future.

There are several ways for banks to get involved in green finance, such as offering green loans or investing in environmentally focused companies or funds. By taking advantage of these opportunities, banks can position themselves as leaders in the fight against climate change while also making a positive return on investment.

Final Thought

To meet the needs of tomorrow’s digital consumer, banks must start rethinking their customer experience today. With new fintech and digital challengers changing the landscape, banks can no longer afford to fall behind. They can ensure they are prepared for 2023 and beyond by keeping an eye on these five trends. If you’re looking for help improving your customer journey and experience, Quinnox is here to help. We specialize in delivering cutting-edge software solutions tailored to meet the unique needs of our clients in the banking sector. Contact us today to learn more about how we can help you improve your customer experience.