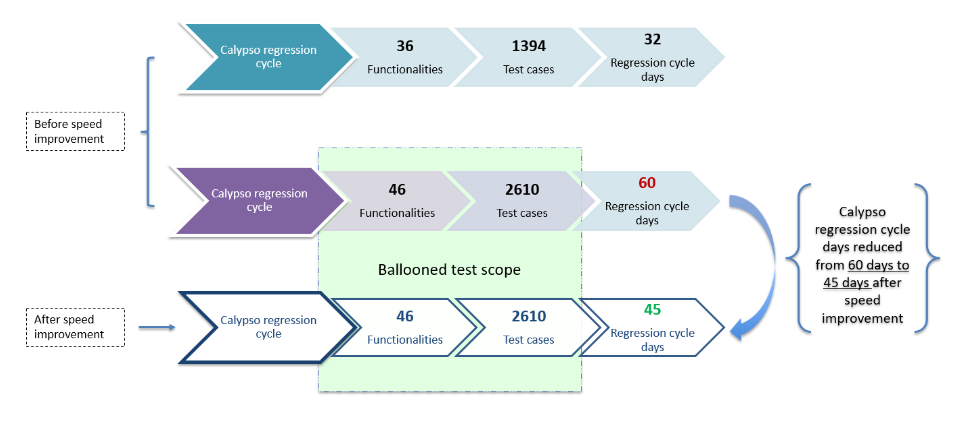

How Calypso Can Help Banks Address Legacy Trading System Challenges to Maximize Efficiency

Legacy trading systems have served as the financial industry's backbone; however, these systems have significant flaws that prevent banks from keeping up with changing regulatory landscapes.

Read more