In the 1960s, insurance companies were at the forefront of digital innovation. COBOL-based mainframes revolutionized operations, introducing automation to underwriting, policy administration, and claims long before other industries caught up. These systems became the backbone of reliability – processing millions of transactions with unmatched precision and stability.

But decades later, what was once revolutionary is now restrictive. These legacy systems – rigid, monolithic, and isolated – are no longer built for a world defined by cloud computing, artificial intelligence (AI), real-time analytics, and digital-first customer expectations.

Today, as insurers face pressure to innovate faster, comply with evolving regulations, and deliver hyper-personalized experiences, their aging technology stack has become a bottleneck to progress. This is why the industry is embracing legacy system transformation – a strategic reimagining of core insurance platforms to enhance agility, efficiency, and intelligence.

According to Gartner, by 2028, insurers that deploy intelligent applications in at least three core business functions will improve operational efficiency by 25%. The implication is clear: modernization is no longer optional – it’s the foundation for future competitiveness.

Modernizing a legacy insurance system is not just a technology upgrade; it’s a complete reinvention of how insurers operate, innovate, and deliver value in the digital era.

Benefits of Insurance Legacy System Transformation

Legacy modernization is the cornerstone of digital transformation in insurance. It enables insurers to evolve from transaction-driven systems to data-driven, AI-empowered ecosystems. Let’s break down its multifaceted benefits.

1. Enhanced Operational Agility

Legacy systems were built for stability, not speed or scalability. With legacy application modernization, insurers can move to micro-services and cloud-native architectures that decouple business capabilities into modular components. This allows insurers to:

- Launch products faster: What once took months to configure, and test can now be achieved in weeks.

- Enable real-time policy changes: API-driven integration allows instant updates across distribution channels.

- Support ecosystem expansion: Modern systems can connect easily with insurtechs, banks, and fintech partners through secure APIs.

For instance, a modernized claims platform can instantly pull external data (e.g., from IoT sensors or telematics devices) to assess risk or validate an accident – enabling faster, more accurate decisions. This agility turns IT from a cost center into a growth enabler, allowing insurers to pivot quickly to new products, markets, or customer demands.

2. Cost Reduction and Performance Gains

Maintaining mainframe-based systems drains both budgets and resources. According to industry study, insurers spend up to 70–80% of their IT budgets on maintaining legacy systems – resources that could otherwise fund innovation. Legacy mainframe modernization through cloud migration or mainframe offloading drastically reduces this burden by:

- Eliminating high hardware and licensing costs.

- Enabling pay-as-you-go scalability.

- Reducing manual maintenance overhead through automation.

For example, mainframe modernization initiatives often deliver 30–40% cost savings within the first year. Moreover, cloud-native environments offer elasticity – meaning insurers can scale computing power up or down based on demand, avoiding wasteful overprovisioning. The result is a leaner, faster, and more cost-efficient IT backbone that supports business growth.

3. Better Data Utilization

Insurance has always been a data-intensive industry. However, legacy systems often store valuable information in isolated silos – policy, claims, and underwriting systems rarely “talk” to each other. Modern platforms integrate AI, ML, and predictive analytics to unify data across sources, providing a single source of truth. This enables insurers to:

- Build predictive models for claims forecasting and risk analysis.

- Personalize pricing based on customer behavior and lifestyle.

- Detect fraud using pattern recognition and anomaly detection algorithms.

For instance, integrating AI into claims data can help predict fraudulent activity before payment, saving millions annually. Similarly, AI-driven risk models can refine underwriting accuracy, improving profitability. By turning raw data into actionable insights, modernization transforms insurance from a reactive to a proactive and predictive discipline.

4. Regulatory Compliance and Security

In the highly regulated insurance domain, compliance is non-negotiable. Regulations like GDPR, HIPAA, or IRDAI guidelines demand stringent controls over data privacy and auditability.

Modern cloud-based systems simplify compliance through:

- Automated governance with real-time monitoring and audit trails.

- End-to-end encryption for sensitive policyholder data.

- Zero-trust security frameworks that protect against cyber threats.

In essence, modernization not only reduces compliance risk but also improves insurer reputation and customer trust.

5. Customer Experience Reinvention

Today’s policyholders expect instant, personalized, and frictionless experiences. Legacy systems – built around batch processing and manual workflows – can’t meet this demand.

Modernized systems enable:

- Self-service portals for quick policy access and renewals.

- AI-powered chatbots for 24/7 assistance and faster claims support.

- Omnichannel engagement, ensuring consistent experiences across mobile apps, websites, and agents.

According to Capgemini’s World Insurance Report, nearly 35% of customers switch insurers due to unsatisfactory digital experiences. Modernization helps close that gap by integrating front-end channels with intelligent back-end workflows – turning customer engagement into a competitive differentiator.

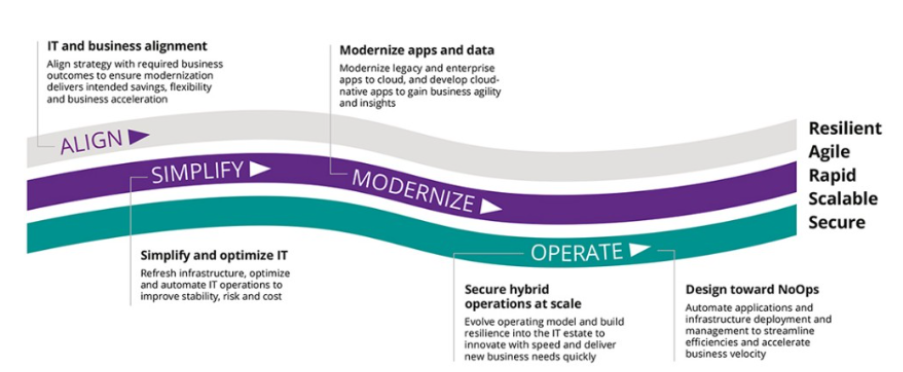

Source: DXC

Best Practices for Successful Insurance Legacy Modernization

A successful modernization strategy is not one-time migration project; it’s a continuous transformation journey. Insurers can follow these best practices to ensure long-term success:

1. Assess and Prioritize Systems

Begin with a technical and business readiness assessment. Identify critical applications that hinder agility or scalability. Classify systems into categories:

- Rehost: Move applications to cloud without changing core code.

- Refactor: Optimize for cloud performance with minor code changes.

- Rearchitect: Redesign applications using microservices and APIs.

- Replace: Retire outdated systems and adopt new SaaS or custom-built platforms.

This approach ensures modernization efforts are cost-effective and aligned with business priorities, not just IT agendas.

Source: Gartner

Don’t Miss Out on this Read: 7 Business Benefits of Legacy Application Modernization

2. Start with Business Outcomes

Successful modernization starts with a clear vision of what success looks like. Insurers should define measurable KPIs such as:

- Reduced claims processing time (e.g., from 10 days to 2 days).

- Improved underwriting accuracy.

- Decreased maintenance costs by 30%.

By tying modernization to outcomes, leadership can ensure that every technology investment delivers quantifiable business value.

3. Embrace Cloud and API-First Architecture

Cloud is the backbone of modern insurance operations. A cloud-native architecture allows insurers to scale, integrate, and innovate faster.

Meanwhile, an API-first approach promotes interoperability – enabling insurers to connect with third-party insurtechs, regulators, and data providers. For instance, APIs can pull telematics data into risk models or integrate AI-driven tools for instant fraud detection. This modular flexibility makes modernization sustainable and future-ready.

4. Leverage AI and LLMs

AI and LLMs (Large Language Models) are redefining how insurers handle data and operations. When integrated into modernized systems, they can:

- Automate policy document generation and compliance checks.

- Extract insights from unstructured data such as emails or claims notes.

- Provide contextual customer service through chatbots.

For example, using LLMs to process claim documents can reduce manual review time by up to 40%, increasing accuracy and efficiency. AI also enables hyper-personalization, allowing insurers to recommend products tailored to customer needs in real time.

5. Manage Change and Upskilling

The biggest modernization barrier isn’t technology – it’s people. Resistance to change can derail transformation initiatives.

Insurers should:

- Establish change management programs to align culture with modernization goals.

- Upskill employees in cloud, AI, and data analytics.

- Encourage cross-functional collaboration between IT, operations, and business units.

Investing in people ensures modernization isn’t just adopted – it’s embraced across the organization.

Real-World Examples: How Industry Leaders Are Modernizing

Several insurance leaders have already begun reimagining their core platforms—and the results speak volumes.

- MetLife modernized its core systems using micro services and cloud to enable faster product deployment across 40+ markets.

- AXA leveraged AI-driven automation and migrated its legacy systems to a hybrid cloud, improving claims processing times by 35%.

- Prudential adopted containerized applications to reduce operational dependencies, leading to 40% lower IT maintenance costs.

- Zurich Insurance used application modernization trends such as low-code integration and predictive analytics to deliver personalized customer experiences.

These pioneers showcase how modernization, when aligned with business outcomes, accelerates digital transformation.

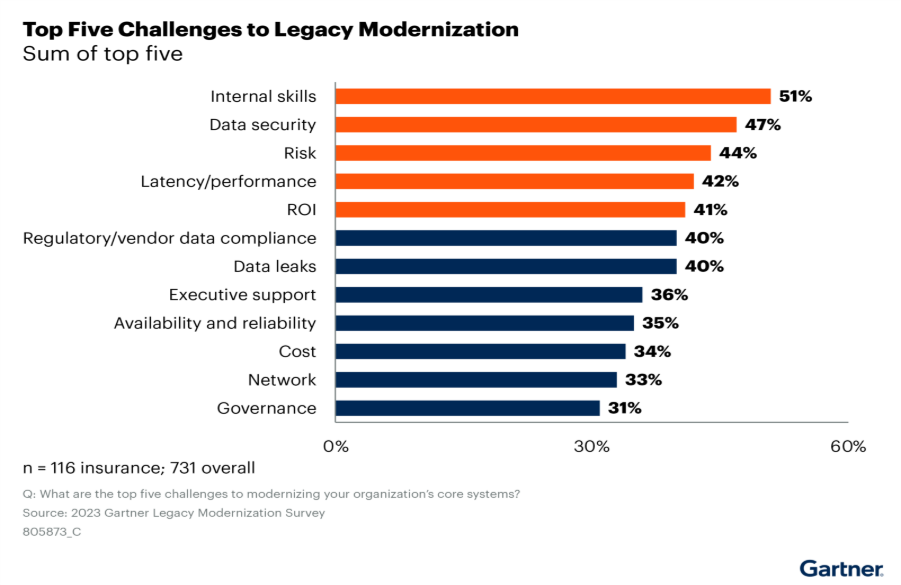

Challenges of Insurance Legacy Modernization

While the benefits are clear, the road to modernization is often riddled with challenges.

Source: Gartner

1. System Complexity and Integration Risks

Legacy systems are deeply interconnected, often running mission-critical processes. Migrating them can lead to integration issues or data inconsistencies if not planned carefully. A phased migration approach, coupled with data virtualization and rigorous testing, helps minimize these risks.

2. High Costs and Downtime Risks

Modernization requires significant upfront investment – especially for core policy administration or claims systems. However, the ROI often justifies the cost within 18–24 months through savings and operational efficiencies. Insurers should adopt incremental modernization, balancing cost control with progress.

3. Talent Shortage

COBOL developers are retiring, while expertise in AI and cloud is still scarce. Bridging this talent gap is vital. Insurers must focus on reskilling, partnering with technology providers, and co-creating solutions to accelerate transformation.

4. Data Governance and Regulatory Compliance

Transferring decades of customer data across systems and jurisdictions poses compliance challenges. Implementing robust data governance frameworks and automated compliance checks ensures regulatory adherence throughout migration.

5. Organizational Resistance

Modernization can disrupt established workflows. Without strong leadership buy-in and stakeholder alignment, projects risk stalling. Building a culture that values agility and continuous improvement is essential for sustained success.

Conclusion

The insurance sector stands at the brink of a defining decade. Legacy systems that once symbolized reliability and control must now evolve to deliver intelligence, automation, and agility.

Through modernization powered by cloud, AI, and LLMs, insurers can finally unlock the untapped potential of decades of data – turning it into predictive insights, smarter underwriting, and seamless customer experiences. Insurance legacy system modernization is no longer about keeping pace; it’s about leading with intelligence.

At Quinnox, we help insurers make this shift from legacy to limitless. Our intelligent application management platform, Qinfinite, empowers insurers to modernize confidently with an AI-powered, cloud-native ecosystem that accelerates transformation, enhances interoperability, and builds resilient digital foundations.

By combining intelligent automation with deep domain expertise, Quinnox enables insurers to reimagine core operations, reduce modernization risk, and deliver next-generation customer value – faster, smarter, and at scale. The future of insurance belongs to the intelligent enterprise. With Qinfinite, that future begins today.

Don’t just take our word for it. Book a free 120-minutes Consultation with Qinfinite Experts Today!

FAQs About Legacy System Transformation

It refers to the process of upgrading or rear–chitecting old insurance systems to align with modern cloud, AI, and data technologies for greater agility and efficiency.

LLMs can automate document processing, enhance customer service, and streamline compliance by interpreting large volumes of policy data with contextual accuracy.

Assessment, prioritization, rearchitecting, integration, and continuous improvement—aligned with application modernization approaches and business outcomes.

Integration risks, downtime, skill gaps, and regulatory complexities—often cited among top application modernization challenges.

Because intelligent automation and data-driven decisions are no longer competitive advantages—they are survival necessities. As Gartner notes, insurers embracing intelligent applications across functions will lead the next wave of efficiency and growth.