Accelerate IT operations with AI-driven Automation

Automation in IT operations enable agility, resilience, and operational excellence, paving the way for organizations to adapt swiftly to changing environments, deliver superior services, and achieve sustainable success in today's dynamic digital landscape.

Driving Innovation with Next-gen Application Management

Next-generation application management fueled by AIOps is revolutionizing how organizations monitor performance, modernize applications, and manage the entire application lifecycle.

AI-powered Analytics: Transforming Data into Actionable Insights

AIOps and analytics foster a culture of continuous improvement by providing organizations with actionable intelligence to optimize workflows, enhance service quality, and align IT operations with business goals.

According to Gartner, the global public cloud expenditure is expected to surpass $723 billion by 2025, reflecting the critical role cloud technology plays in driving modern business transformation. But, with growth comes risk. As organizations accelerate their cloud adoption to drive innovation and agility, one challenge that consistently rises to the top is cost control.

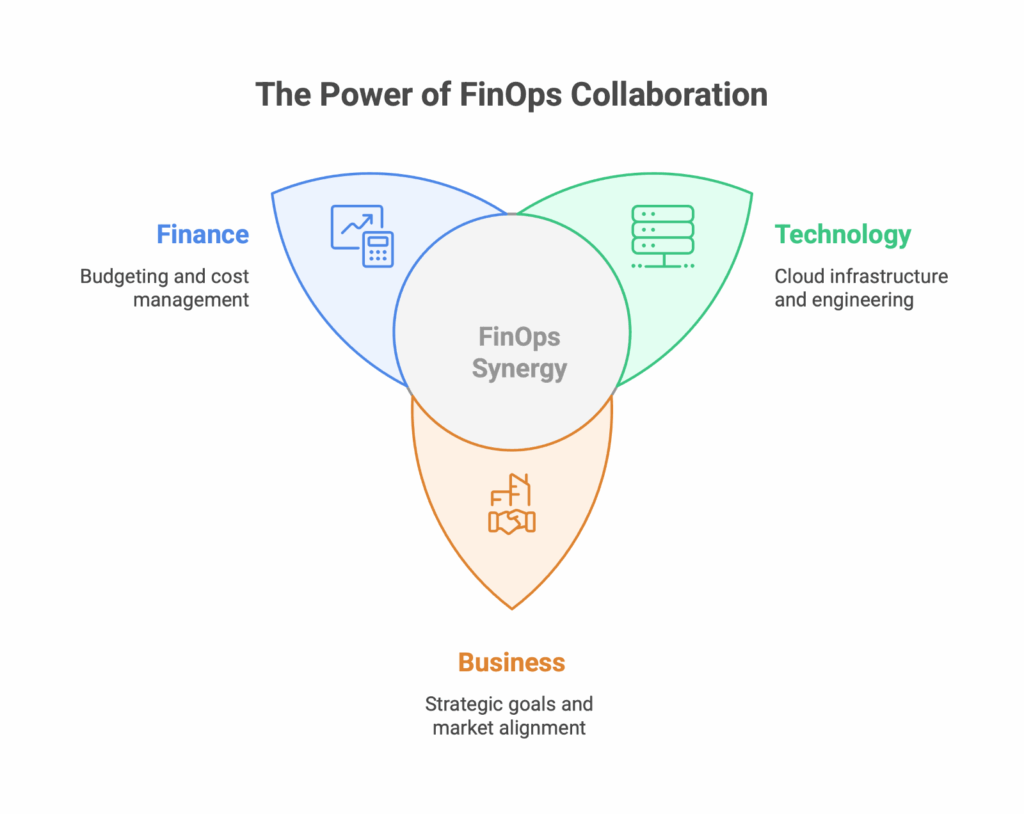

Despite good intentions and strategic investments, many companies find themselves blindsided by hefty bills, unused resources, and a startling lack of financial accountability. This disconnect between cloud investment and value realization is costing enterprises millions. That’s where FinOps comes in. More than just a set of tools or processes, FinOps represents a cultural shift—bringing engineering, finance, and business teams together to build accountability, transparency, and cost efficiency into every cloud decision.

Organizations that embrace FinOps practices often achieve cloud cost savings ranging from 20% to 30%, unlocking greater financial efficiency and control as revealed by Mckinsey. However, FinOps delivers the greatest impact when integrated from the very beginning of a company’s cloud migration, adopting its principles at any stage can still yield substantial advantages.

Hence, whether you’re just getting started or looking to mature your FinOps practice, this guide will help you turn cloud costs from a source of anxiety into a competitive advantage with insights on:

- What is FinOps and its core principles that drive successful adoption

- Best practices used by leading organizations to optimize cloud spend

- A step-by-step implementation guide to help you build or scale your FinOps function effectively

A recent survey found that 48% of M&A professionals are now using AI in their due diligence processes, a substantial increase from just 20% in 2018, highlighting the growing recognition of AI’s potential to transform M&A practices.

What is FinOps?

FinOps, also referred to as cloud cost management or cloud financial management, is an operational framework and cultural practice that helps businesses get the most out of their cloud investments. The primary mission of FinOps is to help organizations get the maximum business value from every dollar spent in the cloud, fostering a transparent environment where teams can make informed trade-offs between speed, cost, and quality.

FinOps represents a fundamental shift from traditional IT financial management. Before the cloud era, managing technology costs was a relatively straightforward process: organizations relied on lengthy procurement cycles, significant upfront capital expenditures (CapEx), and fixed annual budgets. Technology was treated as a cost center with predictable, mostly static expenses, making financial planning more rigid and centralized.

The cloud, however, completely transformed this landscape. It introduced an operational expenditure (OpEx) model where costs fluctuate based on actual usage, resources can be spun up or down on demand, and provisioning is decentralized so that any engineer can deploy infrastructure in minutes without going through lengthy approval processes. But on the other hand, this newfound agility accelerated innovation and brought in complexity and unpredictability in spending.

This is where FinOps became essential. By establishing a common language, shared goals, and collaborative practices, FinOps enables organizations to harness cloud agility while maintaining financial discipline. It ensures that spending decisions are data-driven and transparent, aligning engineering efforts with business outcomes.

FinOps Framework: The Three Core Phases

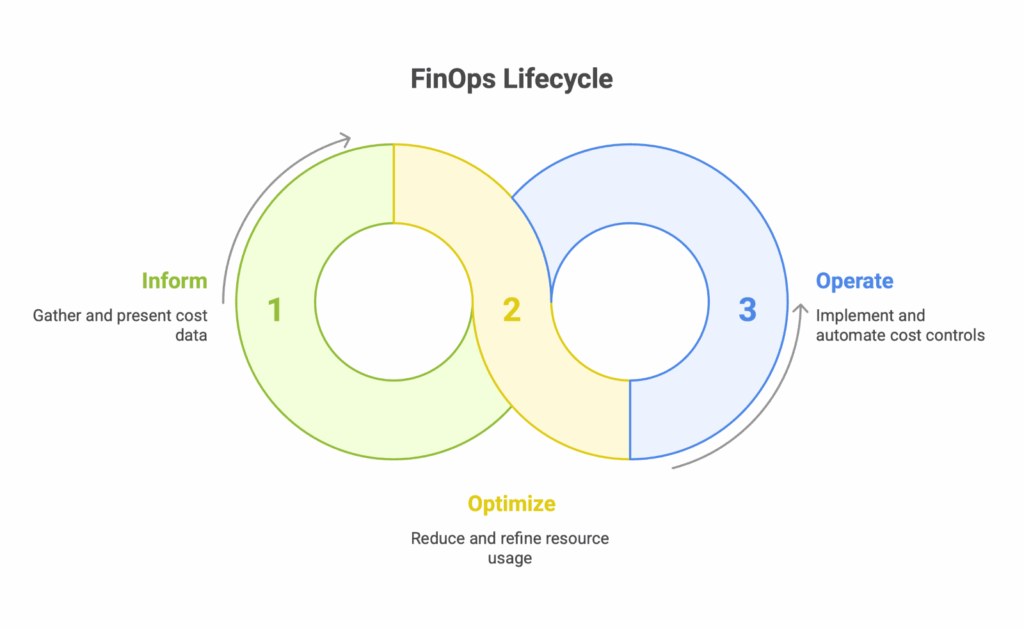

The FinOps framework is not a linear, one-time project. It is an iterative and continuous lifecycle designed to embed financial intelligence into every stage of your cloud journey. This cycle is composed of three interconnected phases: Inform, Optimize, and Operate. Mastering this flow allows an organization to evolve from reactive cost control to proactive value management.

1. Inform Phase

The Inform phase is the foundational bedrock of any successful FinOps practice. You cannot control what you cannot see. The primary goal here is to provide accurate, timely, and granular visibility into cloud spending for all stakeholders. For C-Suite executives, this means understanding the total cost of ownership (TCO) and aligning cloud spend to business units. For engineers, it means seeing the cost impact of the specific services they are deploying.

Key activities in this phase include:

- Comprehensive Tagging and Labeling: Establishing and enforcing a strict resource tagging policy is non-negotiable. Tags act as the metadata that allows costs to be sliced and diced by project, team, environment, application, or any other relevant business dimension.

- Cost Allocation and Showback: Once tagged, costs can be accurately allocated to the teams that incurred them. A “showback” model presents this data to teams, fostering awareness. A more mature “chargeback” model formally allocates these costs to departmental budgets, creating direct accountability.

- Centralized Reporting and Dashboards: Data must be aggregated from various cloud providers and presented in accessible, easy-to-understand dashboards. These dashboards should provide different views tailored to different personas, from high-level executive summaries to detailed resource-level reports for engineers.

2. Optimize Phase

With clear visibility established, the Optimize phase focuses on actively improving cloud cost efficiency. This is where the organization moves from understanding costs to influencing them. It involves a combination of technical and financial strategies to eliminate waste and ensure resources are aligned with demand. Optimization levers include:

- Right-Sizing Resources: This is often the most significant source of savings. It involves analyzing performance metrics to identify and downsize over-provisioned virtual machines, databases, and storage volumes, ensuring you only pay for what you actually need.

- Eliminating Waste: This includes identifying and decommissioning “zombie” resources—idle virtual machines, unattached storage volumes, and old snapshots—that are consuming budget without providing any value. Automation is key here to continuously scan for and flag such waste.

- Leveraging Commitment-Based Discounts: Cloud providers like AWS and Azure offer significant discounts (up to 72%) in exchange for a commitment to a certain level of usage over a one- or three-year term (e.g., Savings Plans, Reserved Instances). Intelligent analysis of usage patterns is required to make these commitments confidently without over-committing.

3. Operate Phase

The Operate phase is about operationalizing FinOps and embedding it into the culture. The goal is to make cost-awareness a continuous, automated, and collaborative function, not a periodic, manual review. This is where FinOps becomes “business as usual.”

Key operational activities include:

- Establishing Automated Governance: Implement policies that automatically enforce cost-saving behaviors. For example, a policy could automatically shut down development environments outside of business hours or prevent the launching of un-tagged resources.

- Creating Real-Time Feedback Loops: Integrate cost data directly into the tools that engineers use every day, such as CI/CD pipelines and Slack. A developer should be able to see the potential cost impact of a code change before it gets to production.

- Defining and Tracking Business Value Metrics: Mature FinOps practices move beyond just tracking savings. They define unit economic metrics, such as cost per customer, cost per transaction, or cost per feature. This shifts the conversation from “How much are we spending?” to “What business value are we getting for the cloud spent?”

Key Principles of FinOps

The FinOps Foundation outlines six core principles that serve as the north star for successful practice. Understanding and embracing these principles is essential for any organization wondering what FinOps principles are:

Teams Need to Collaborate

FinOps is fundamentally a team sport. It breaks down the traditional silos between Finance, Engineering, Product, and Business teams. In a FinOps culture, engineers learn to think about cost, and finance professionals learn about cloud architecture. This shared understanding fosters proactive conversations about trade-offs, ensuring that decisions are not made in a vacuum.

Everyone Takes Ownership for Their Cloud Usage

The days of a central IT team approving every infrastructure request are over. The cloud empowers engineers to provision resources on demand. With this power comes responsibility. This principle dictates that individuals and teams consuming cloud resources are accountable for managing them within their budget, driving a powerful sense of ownership and accountability at the edge.

A Centralized Team Drives FinOps

While ownership is decentralized, strategy and governance must be centralized. A central FinOps team, or Center of Excellence (CoE), acts as the facilitator and enabler for the rest of the organization. They are not gatekeepers; they are experts who provide the tools, best practices, and training that empower federated teams to manage their own cloud spend effectively.

Decisions are Driven by the Business Value of Cloud

The ultimate goal of FinOps is not to spend the least amount of money possible; it is to maximize the business value derived from the cloud. For example, instead of asking “Can we reduce our database costs?” the question then becomes “Does the performance of this more expensive database generate enough revenue or customer satisfaction to justify its cost?”

Reports Should Be Accessible and Timely

In the dynamic world of the cloud, a monthly report is already ancient history. To make effective decisions, teams need access to cost and usage data that is as close to real-time as possible. Waiting weeks to discover a cost anomaly means weeks of budget waste. Accessible, self-service dashboards are critical to empowering teams to act quickly.

Take Advantage of the Variable Cost Model of the Cloud

Organizations should lean into the cloud’s elasticity, not fear it. This means moving away from static forecasting and embracing dynamic planning. It involves using auto-scaling to match capacity with demand, leveraging spot instances for fault-tolerant workloads, and continuously adjusting the infrastructure footprint to optimize cost and performance.

Benefits of Implementing FinOps

Adopting a FinOps culture delivers tangible benefits that extend far beyond the balance sheet. It transforms how an organization operates, innovates, and competes.

- Enhanced Financial Control and Predictability: By providing real-time visibility and establishing clear accountability, FinOps significantly reduces the risk of budget overruns. Forecasting becomes more accurate, allowing the CFO and finance teams to plan with confidence.

- Increased Business Agility and Innovation: When engineers have cost data at their fingertips, they can make smarter architectural decisions faster. This removes the financial guesswork that often acts as a bottleneck, accelerating product development and a faster time-to-market.

- Improved Cross-Functional Collaboration: FinOps creates a shared language and common set of metrics that align Finance, Technology, and Business teams. This breaks down adversarial relationships (e.g., “Finance is always telling us to cut costs”) and builds a partnership focused on achieving shared business goals.

- Systematic Waste Reduction: A mature practice for FinOps systematically identifies and eliminates wasted spending from idle resources, over-provisioning, and orphaned storage. This frees up budget that can be reinvested into innovation and growth.

- Stronger Connection to Business Value: Perhaps the most strategic benefit is the ability to directly correlate cloud spending with business outcomes. This elevates the conversation from IT costs to business investment, enabling leaders to make strategic decisions about where to double down and where to pull back.

Best Practices for Effective FinOps

Knowing the principles is one thing; putting them into practice is another. Here are actionable best practices to build a successful and effective FinOps function.

Establish a Comprehensive Tagging and Labeling Strategy

Tagging policy is the cornerstone of visibility. Your policy should be mandatory and automated where possible. Define a consistent set of tags for all resources, such as owner, project code, cost-center, environment (e.g., prod, dev, staging), and application-name. This ensures every dollar spent can be attributed correctly.

Automate Anomaly Detection and Waste Identification

Do not rely on humans to manually scan dashboards for cost spikes. Implement automated anomaly detection systems that alert the appropriate team via Slack or email the moment spending deviates from the norm. Likewise, use automated scripts to continuously identify idle resources like unattached disks or underutilized VMs.

Build a Culture of Cost-Awareness Through Education

You must actively evangelize FinOps within your organization. Host regular training sessions and workshops for engineering teams. Share success stories and highlight teams that are doing a great job managing their costs. Create “cost-aware” design reviews as part of the software development lifecycle to discuss the cost implications of new features.

Regularize Optimization Cycles

Optimization is not a one-off event. It should be a regular and scheduled activity. Establish weekly or bi-weekly cycles where teams review optimization recommendations for rightsizing and waste cleanup. Treat this with the same importance as a security review or a performance audit.

Leverage Commitment-Based Discounts Intelligently

Do not rush into three-year commitments without data. Use an advanced analytics platform to understand your stable baseline usage over time. Purchase Reserved Instances or Savings Plans to cover this predictable baseline and continue to use on-demand pricing for spiky, unpredictable workloads. This hybrid approach maximizes savings while preserving flexibility.

Implementation Guide: How to Roll Out FinOps in Your Organization

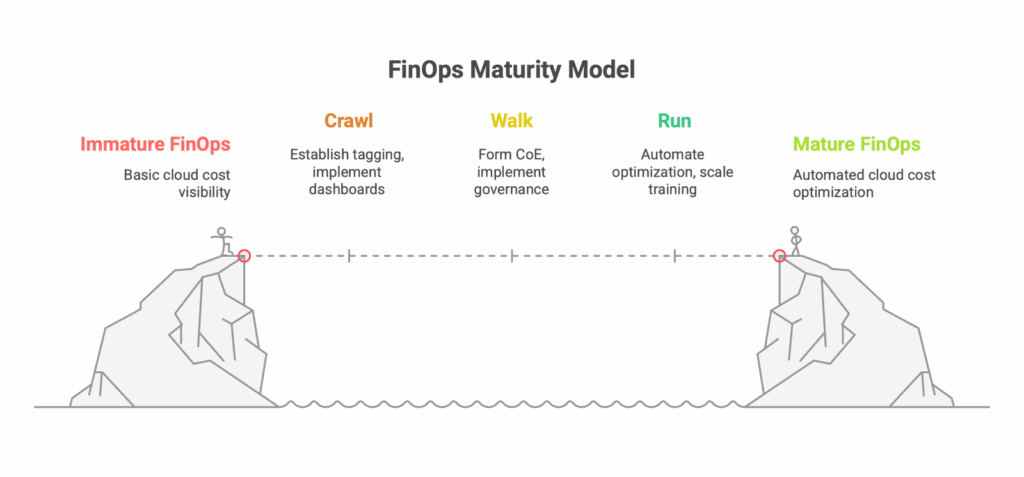

Knowing how to implement FinOps can feel daunting. The key is to approach it as an iterative journey using a maturity model, often described in three stages: Crawl, Walk, and Run.

Step 1: Start Small with a Crawl Phase

In the Crawl phase, the goal is to achieve basic visibility and start building momentum.

- Build a Pilot Team: Select a single business unit or application team to be your FinOps pilot.

- Focus on the Inform Phase: The immediate priority is getting visibility. Implement your initial tagging strategy for this team and set up a basic cost dashboard using native cloud tools.

- Identify Low-Hanging Fruit: Find and eliminate obvious waste, such as old snapshots or clearly oversized development servers, to score some quick wins and demonstrate value.

Step 2: Build Your Central Team & Define Governance (Walk Phase)

As you expand beyond the pilot, you enter the Walk phase, where you formalize the practice.

- Establish Key Roles in FinOps Teams: Formally create your central FinOps team. This team typically includes a FinOps Lead, Cloud Analysts, and representatives from Finance and Engineering.

- Define Governance Policies: Codify your tagging policy and begin to introduce automated governance. For example, implement a policy that prevents the launch of untagged resources.

- Introduce Optimization: Begin more sophisticated optimization activities like rightsizing and start analyzing usage to plan your first small purchase of a commitment-based discount.

Step 3: Socialize and Educate

With defined processes, you must now scale the culture.

- Develop Training Programs: Create onboarding materials and run regular workshops to educate engineering and product teams on FinOps principles and their specific responsibilities.

- Appoint FinOps Champions: Identify enthusiastic advocates within different engineering teams to act as local champions. They can help answer questions and drive adoption within their teams.

Step 4: Scale with the Walk and Run Phases

The Run phase represents a mature FinOps maturity model.

- Scale Across the Organization: Roll out established processes and tools for all teams.

- Automate Everything: The focus shifts heavily to automation—automating optimization recommendations, budget alerting, and operational processes.

- Focus on Unit Economics: Shift from tracking raw cost to tracking business value metrics. The conversation moves from cost savings to value creation, fully realizing the strategic potential of your FinOps initiative.

Challenges in FinOps Adoption and How to Overcome Them

The path to FinOps maturity is not without its challenges. Being aware of these common hurdles is the first step to overcoming them.

Challenge: Cultural Resistance

The most significant barrier to adoption is often cultural. Engineers may see cost management as a distraction, and finance teams may be reluctant to relinquish centralized control.

- Solution: Overcoming this requires strong executive sponsorship. Leadership must clearly communicate that FinOps is a strategic priority. Frame the benefits for each group: for engineers, it’s about empowerment and faster delivery; for finance, it’s about predictability and control.

Challenge: Data Overload and Inaccuracy

Cloud billing data is notoriously complex and voluminous. Without the right tools and processes, it can be overwhelming and lead to inaccurate cost allocation.

- Solution: A standardized, enforced tagging policy is the first line of defense. The next step is investing in a centralized platform capable of ingesting, normalizing, and presenting this data in an intuitive way, cutting through the noise to deliver actionable insights.

Challenge: Lack of In-House Skills

FinOps is a relatively new discipline, and finding experienced practitioners can be difficult.

- Solution: Start by investing in training for your existing cloud and finance teams. Begin with a small, dedicated team and allow them to grow their expertise. For organizations that need to accelerate, partnering with a managed service provider can inject the necessary expertise while your internal team ramps up.

Conclusion

As organizations deepen their reliance on the cloud, managing its financial impact moves from a technical challenge to a strategic imperative. FinOps is the essential cultural and operational bridge that connects cloud technology to business value, balancing the need for speed and innovation with the demand for financial governance and predictability. The journey requires a fundamental shift in mindset, driven by collaboration, ownership, and a relentless focus on data. By embracing the principles and practices outlined in this guide, your organization can move beyond simply paying the cloud bill to making every dollar spent in the cloud an investment in your competitive advantage.

Ready to transform your cloud financial operations? Discover how Qinfinite can empower your FinOps journey. Let’s make every cloud dollar count.

Schedule a Discovery Call with Quinnox Experts – Click here to schedule

FAQs About FinOps

A: FinOps, short for Financial Operations, is a cultural and management practice for cloud financial management. It brings together finance, engineering, and business teams to foster financial accountability and maximize the business value of an organization’s cloud spending. It is an iterative process focused on visibility (Inform), efficiency (Optimize), and continuous improvement (Operate).

It is crucial because the variable, on-demand nature of the cloud breaks traditional IT financial models. Without FinOps, organizations often face unpredictable bills, significant waste (30% or more), and a disconnect between technology spending and business outcomes. It provides the framework to control costs, improve forecasting, and ensure that cloud investments are driving real value.

The six core principles are:

1) Teams need to collaborate. 2) Everyone takes ownership of their cloud usage. 3) A centralized team drives the practice. 4) Reports must be timely and accessible. 5) Decisions are driven by the business value of the cloud. 6) Take advantage of the cloud’s variable cost model.

The key benefits include significant reduction in cloud waste, improved budget predictability and forecast accuracy, increased engineering velocity by removing financial bottlenecks, stronger alignment between business and technology teams, and a clear line of sight connecting cloud costs to specific business value metrics.

The FinOps lifecycle consists of three continuous, iterative stages:

- Inform: Gaining visibility and understanding of all cloud costs through tagging, allocation, and reporting.

- Optimize: Actively finding and implementing cost efficiencies through actions like right-sizing resources and leveraging discounts.

- Operate: Operationalizing FinOps through automation, establishing governance, and embedding cost awareness into daily workflows.