In global capital markets, the margin for error is razor – thin. A single reconciliation mistake can cascade into millions of losses, regulatory breaches, or reputational damage before anyone even notices.

At the center of this high-stakes environment sits Calypso (now Nasdaq Adenza), the backbone for trading, risk, collateral, and settlement in many of the world’s largest financial institutions.

But here’s the challenge: while Calypso is mission-critical, migrating or upgrading it remains one of the riskiest undertakings in finance. According to BCG Analysis, nearly 70% of large-scale transformation projects exceed their timelines or budget. In capital markets, failure doesn’t just cost time or money. It can compromise compliance, introduce operational instability, and erode client trust overnight.

Migrations are often riddled with complex data dependencies, years of custom code, and fragile integration points. Testing cycles stretch into weeks yet still miss critical defects. Meanwhile, regulators and business stakeholders demand continuity, speed, and flawless execution.

So, the real question is: how do you take one of the riskiest calypso migration programs in finance and make it predictable?

The answer: by blending process discipline, smart automation, and deep domain expertise. This is where the Quinnox ACT (Assured Calypso Transformation) Framework comes in – a tested methodology that has delivered defect-free migrations, faster upgrades, and future-ready Calypso estates for some of the world’s leading financial institutions.

Key Calypso Migration Challenges

Every Calypso migration is unique, yet a familiar set of challenges recurs across institutions. These are not isolated hurdles but interconnected risks that determine whether a migration strengthens or weakens the enterprise.

Complex Trade Data:

Migrating trade is never a straightforward transfer. Each trade is tied to valuation models, collateral flows, and compliance rules. The real challenge lies in preserving business meaning across systems. Even minor inconsistencies in data structure or reconciliation can ripple into downstream processes like risk reporting or settlements.

Time-Consuming Testing:

Testing is often the single biggest drag on migration timelines. Manual regression cycles are slow, repetitive, and prone to oversight. What should validate stability ends up consuming disproportionate resources, leaving little room for innovation or timely releases. Without smarter approaches, testing becomes a bottleneck that constrains the entire program.

Custom Code and Technical Debt:

Over years of operation, institutions build layers of custom code, overrides, and scripts to meet evolving needs. While these solve short-term requirements, they gradually form a fragile foundation. Unraveling this complexity during migration is critical; otherwise, technical debt silently magnifies risks, making the system more brittle with every upgrade.

Upgrade Fatigue:

As Calypso’s release cadence accelerates, institutions find themselves perpetually in “upgrade mode.” What once felt like a periodic milestone has become a recurring obligation. This constant churn strains teams, diverts focus from innovation, and risks creating a culture of fatigue where upgrades are seen as burdens, not opportunities.

Stakeholder Alignment:

Calypso does not sit in isolation. It connects trading desks, risk teams, operations, and compliance. When these groups are misaligned, the result is predictable: gaps in requirements, last-minute changes, and painful surprises post go-live. True migration success depends as much on cross-functional alignment as on technical execution.

In short: the risk isn’t just in moving to the new platform – it’s in everything that surrounds it: testing, validation, compliance, and adoption.

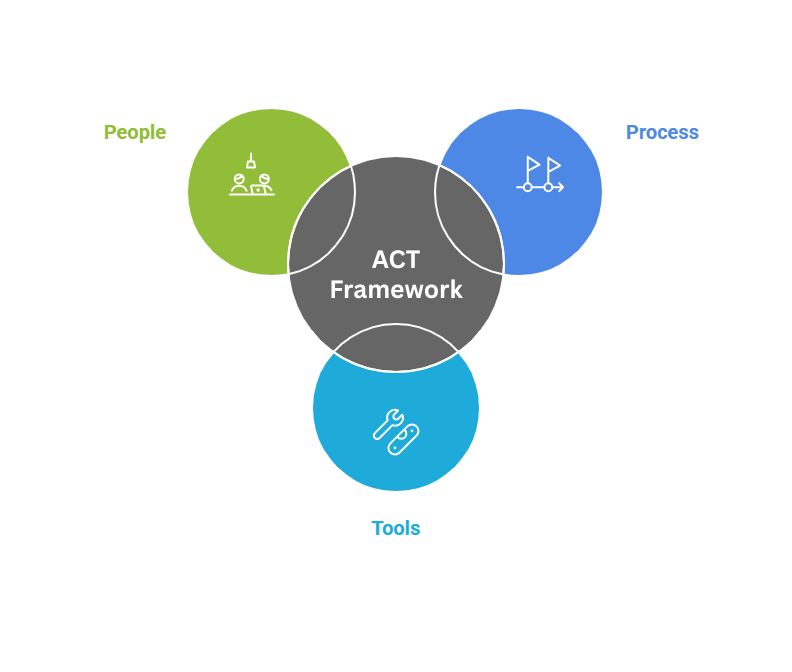

From Complexity to Confidence: The ACT Framework

The Quinnox Assured Calypso Transformation (ACT) Framework was built to tackle exactly these risks head-on. At its core, ACT rests on a three-layered strategy – Process, Tools, and People – designed to bring confidence into every migration.

1. Process – Structured, Repeatable, Reliable

ACT replaces one-off “hero projects” with structured flows that cover first rollouts, monthly releases, and major upgrades. By combining automation, pre-built test assets, and CI/CD practices, every cycle becomes faster, leaner, and more reliable.

2. Tools – Automation Built for Calypso

ACT Framework integrates automation tools purpose-built for Calypso, combining Adenza’s official testing suite with Quinnox’s bespoke accelerators:

- Calypso Automated Testing Tool (CATT)

Developed by Adenza (now Nasdaq), CATT is the backbone of automation in ACT. It uses POJO APIs and supports all types of testing – new asset classes, additional modules, and full regression packs. It provides flexibility and depth, enabling coverage that generic tools cannot deliver.

- SmartCompare

A sophisticated reconciliation engine, SmartCompare ensures field-level accuracy across environments. It delivers 100% precision while handling large data volumes at speed, with built-in exception management to catch issues early. Its intuitive interface makes complex reconciliation simple, even for customized reports and legacy data formats.

- QFrame

An intelligent automation suite, QFrame validates every field linked to a trade, ensuring reporting integrity and data accuracy. Compatible with the latest Calypso versions, it enables end-to-end regression testing and reduces test cycles from days to hours. QFrame has consistently delivered over 90% regression automation, making upgrades and migrations far more efficient.

These tools don’t just accelerate testing – they reframe it. Regression cycles that once took days are reduced to hours. Validations that previously consumed weeks become near real-time checks. Together, they transform testing from a bottleneck into a catalyst for faster, safer delivery.

3. People – Deep Expertise Where It Matters

Behind the tools and processes is Quinnox’s team of more than 130 professionals dedicated to Calypso transformation. This includes certified Calypso experts, QA engineers, and financial domain specialists with backgrounds in back office, technical architecture, risk, and automation. Their depth of expertise means ACT projects don’t begin with a learning curve – they begin with momentum.

And ACT doesn’t stop at migration. It embeds DevSecOps best practices: automated regression packs, CI/CD pipelines, security scanning, code refactoring, and compliance-ready workflows.

The result is leaner, smarter test automation, accelerated regression cycles, and reusable assets that carry forward into future releases – avoiding upgrade fatigue and ensuring ongoing stability.

Real-World Success Stories of Calypso Transformation

Here are three recent cases where ACT principles weren’t just theory – they delivered transformative, repeatable results. Each illustrates how process discipline, automation, and domain expertise conspired to eliminate risk and drive first-time success.

Case Study 1: 25% Faster Upgrades for a Leading Financial Institution

A global financial powerhouse slashed its Calypso regression cycle from 60 days down to 45 by upgrading its testing framework and integrating CI/CD practices. They doubled test case coverage from 1,300 to 2,600+, optimized trade data capture, and parallelized execution to speed up delivery.

Case Study 2: Zero-Defect Go-Live & 40+ Product Migration at Global Asset Manager

While consolidating diverse derivatives operations (Credit, FX, Equity, Interest Rate) onto Calypso, this client saw a game-changer: product migration of over 40 asset products in 24 months with zero defects at go-live. Build testing cycles dropped from 48 hours to just 6 hours, thanks to rigorous automation and scalable platform enhancements.

Read the full case here: Future-Ready Trading Operations: Quinnox Delivers a Scalable Calypso Platform Solution

Case Study 3: Critical Upgrade Delivered 4 Months Early with Million-Dollar Savings

A U.S. financial institution lagging on version upgrades pulled off a high-stakes Calypso upgrade 4 months ahead of plan. They avoided costly delays, saved over $1M annually, achieved zero downtime in go-live, and reduced regression testing effort by 30%. All done without disrupting business as usual.

Discover how they did it: 4 Months Faster: Quinnox Delivers a Seamless Calypso Platform Upgrade with $1M+ in Savings

These stories reinforce the core message: the ACT Framework isn’t about incremental improvement – it’s about architecting Calypso transformations that are timely, cost-efficient, and risk-resistant right from the start.

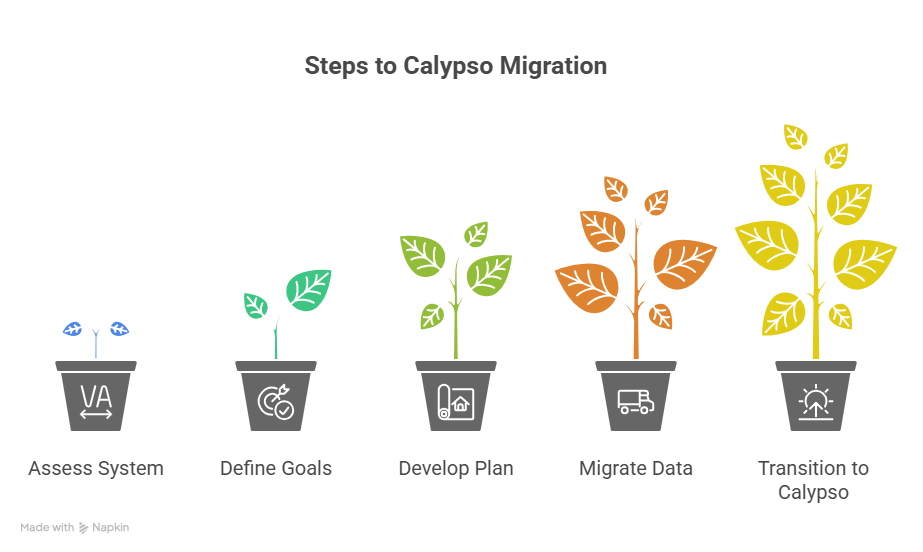

How to Ensure First-Time Success in Calypso Migrations

Even with a proven framework, successful migrations demand disciplined planning and rigorous validation. Here are key recommendations:

- Start with a Diagnostic: Assess your current Calypso estate, technical debt, and custom code early. Decide what to retire, refactor, or retain.

- Plan for Business Alignment: Engage risk, compliance, and operations stakeholders from day one. Map business pain points directly to migration goals.

- Automate Early, Automate Often: Invest in automation accelerators (SmartCompare, QFrame) from the start – not as an afterthought. This ensures consistency across migration and future upgrades.

- Validate Before You Go Live: Don’t just rely on testing. Validate trades, reports, and reconciliations across multiple environments. Real-world best practices show reconciliation time can be reduced by 70% with the right automation in place.

- Think Beyond the Migration: Future-proof your Calypso by adopting DevSecOps practices, containerized environments, and SaaS readiness. This reduces technical debt and accelerates future innovation.

Want a ready-to-use version of these steps? Download our 5-Point Executive Checklist for Calypso Migration Success – a practical roadmap used by leading financial institutions to minimize risk, accelerate validation, and future-proof their Calypso estate.

Conclusion

In today’s high-stakes financial landscape, there is no margin for risky migrations. Calypso may be the backbone of trading and risk, but unless migrations are executed with precision, the very system designed to deliver resilience can become a point of failure.

The ACT Framework from Quinnox changes that equation. By combining structured processes, bespoke automation accelerators (SmartCompare, QFrame, CATT), and a 130+ strong bench of certified Calypso experts, Quinnox transforms migrations from unpredictable to predictable, from resource-draining to efficient, from risky to assured.

So, ready to see how ACT can de-risk your Calypso journey? Book your free diagnostic, see a live ACT Framework demo, and choose from fast, fixed-scope migration packages – all tailored for your success.

FAQ’s Related to Calypso Migrations

Timelines vary based on the complexity of your estate, but our ACT Framework has consistently reduced migration cycles by 25–40% compared to traditional approaches, with automation accelerating testing and validation.

Yes. ACT’s tools, including CATT, SmartCompare, and QFrame, are designed to manage multiple asset classes simultaneously, ensuring accuracy, completeness, and zero-defect go-lives.

Compliance is built into the process. ACT ensures that all trade data, reports, and reconciliations are fully validated and traceable, helping you meet stringent regulatory requirements without last-minute firefighting.

Our experts assess existing customizations and technical debt early. By prioritizing refactoring, leveraging automation, and applying DevSecOps principles, we minimize risk while preserving essential functionality.