Accelerate IT operations with AI-driven Automation

Automation in IT operations enable agility, resilience, and operational excellence, paving the way for organizations to adapt swiftly to changing environments, deliver superior services, and achieve sustainable success in today's dynamic digital landscape.

Driving Innovation with Next-gen Application Management

Next-generation application management fueled by AIOps is revolutionizing how organizations monitor performance, modernize applications, and manage the entire application lifecycle.

AI-powered Analytics: Transforming Data into Actionable Insights

AIOps and analytics foster a culture of continuous improvement by providing organizations with actionable intelligence to optimize workflows, enhance service quality, and align IT operations with business goals.

The insurance industry is undergoing a profound digital transformation, driven by changing customer expectations and disruptive innovations from InsurTech startups. As insurers strive to meet evolving customer demands in a digital-first world, they face challenges in delivering seamless experiences while competing with agile and tech-savvy newcomers.

With InsurTech startups gaining traction and disrupting traditional business models, insurers are confronted with the need to revamp their operations, improve efficiency, and deliver seamless customer experiences to retain and attract clientele in an increasingly digital-first environment.

Moreover, the rise of digital-first customer preferences is reshaping the insurance landscape, with Gartner indicating that by 2025, 80% of customer interactions will occur through digital channels. This shift towards digital engagement requires insurers to optimize their online platforms, streamline digital processes, and enhance the overall customer journey to meet the rising expectations for seamless, user-friendly experiences.

In 2024, the insurance sector stands at a pivotal moment where embracing digital transformation trends is not just a competitive advantage but also a necessity for sustained success. In order to thrive in this rapidly demanding competitive space, insurers must proactively anticipate and wholeheartedly embrace change.

Let’s explore the top 10 insurance digital transformation trends that insurers must prioritize to stay competitive and meet evolving customer demands.

1. Artificial Intelligence and Machine Learning

Artificial Intelligence (AI) and Machine Learning (ML) are revolutionizing the insurance industry by automating complex processes like claims processing, underwriting, and fraud detection. Insurers are leveraging these technologies to analyze vast amounts of data, which enables more accurate risk assessment and personalized customer experiences. AI-powered chatbots are transforming customer service by providing instant support and resolving queries efficiently. These chatbots use natural language processing to understand and respond to customer inquiries, improving satisfaction and reducing operational costs.

Lemonade, a digital insurance company, uses AI to process claims in minutes, significantly enhancing efficiency and customer satisfaction. AI algorithms can quickly identify fraudulent claims, assess risk levels, and determine premium prices, thus streamlining operations and reducing costs. The use of ML models also helps insurers predict customer behavior, allowing for more tailored insurance products and services.

2. Blockchain Technology

Blockchain technology is enhancing transparency and security in insurance transactions by ensuring that all parties have access to the same data, thus reducing fraud and errors. In 2024, more insurers are expected to adopt blockchain for smart contracts and secure data sharing.

The B3i initiative, where major insurance companies collaborate to create a blockchain-based reinsurance platform, is a prime example. Blockchain’s decentralized ledger system provides a tamper-proof record of all transactions, which is crucial for verifying claims and underwriting processes. This technology also facilitates faster and more secure cross-border transactions, improving operational efficiency.

3. Big Data and Predictive Analytics

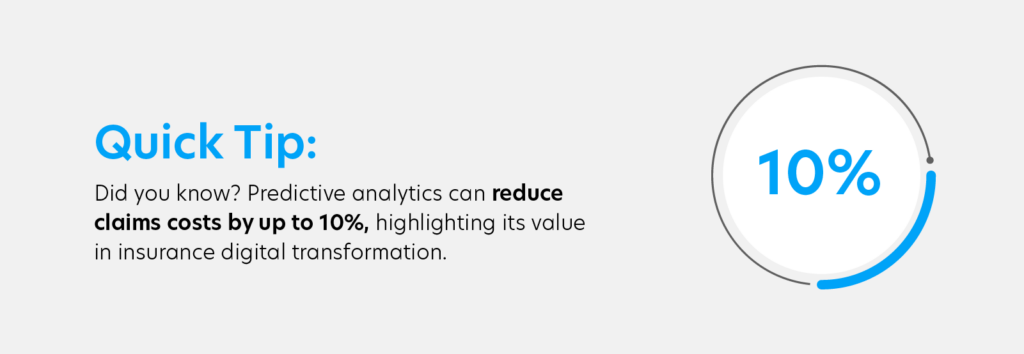

Big data and predictive analytics are transforming how insurers operate, enabling them to make data-driven decisions that improve risk management and customer service. By analyzing data from various sources, insurers can identify trends, forecast future events, and develop more accurate risk profiles. Predictive analytics helps insurers anticipate customer needs and behaviors, allowing for proactive engagement and personalized product offerings.

For instance, John Hancock’s Vitality program uses data from wearable devices to provide customized life insurance policies based on individual health metrics. This data-driven approach not only enhances customer satisfaction but also promotes healthier lifestyles, reducing the overall risk for insurers.

4. Digital Platforms and Ecosystems

Digital platforms are central to the insurance digital transformation, providing a unified interface for customers to access various services. These platforms integrate underwriting, claims management, and customer service, offering a seamless experience. By leveraging these platforms, insurers can offer a one-stop solution for all insurance-related activities, from policy purchase to claims processing. This not only enhances customer convenience but also allows insurers to gather valuable data across different touchpoints, improving service delivery and product innovation.

A study by McKinsey predicts that by 2025, digital ecosystems could account for 30% of global revenues, underscoring the importance of digital transformation solutions in driving business growth. Insurers that build and participate in digital ecosystems are better positioned to offer comprehensive, value-added services and capture new market opportunities.

5. Rise of Internet of Things (IoT) and Telematics

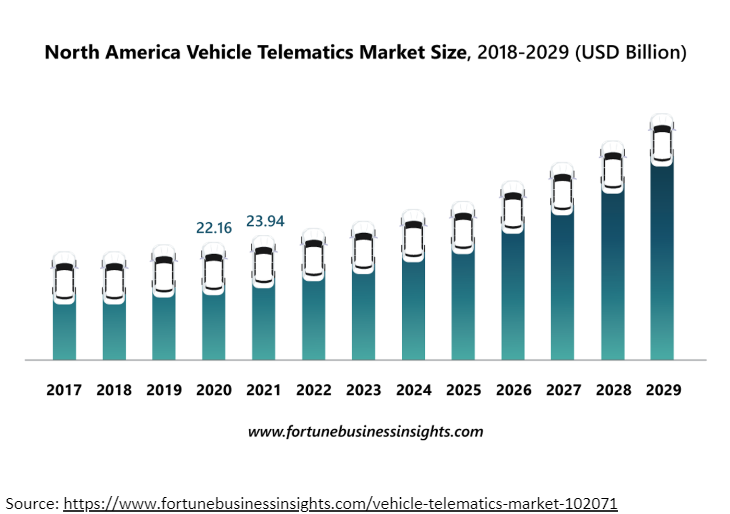

The Internet of Things (IoT) and telematics are revolutionizing the insurance industry by providing real-time data for risk assessment and personalized policies. IoT devices, such as connected cars, smart homes, and wearable health devices, collect vast amounts of data that insurers can use to understand customer behavior and manage risks better.

Take the instance of vehicle telematics in auto insurance that tracks driving habits, allowing insurers to offer usage-based insurance (UBI) policies, rewarding safe drivers with lower premiums. This trend is not only enhancing customer satisfaction through personalized offerings but also reducing claims by encouraging safer behavior.

6. Cybersecurity and Data Protection

With the increasing reliance on digital solutions, cybersecurity has become a top priority for insurers. The industry is investing heavily in advanced cybersecurity measures to protect sensitive data and maintain customer trust. According to Cybersecurity Ventures, global spending on cybersecurity products and services will exceed $1 trillion cumulatively over the next five years, highlighting its critical importance.

Insurers are adopting multi-layered security protocols, including encryption, biometric verification, and AI-powered threat detection systems, to safeguard against data breaches and cyberattacks. Ensuring robust cybersecurity is essential not only for compliance with regulatory requirements but also for preserving the integrity of digital transformation services.

7. Customer-Centric Transformation

Digital transformation solutions focused on customer centricity are reshaping the insurance industry. These solutions include omnichannel experiences, seamless digital onboarding, and personalized communication. By prioritizing customer needs and preferences, insurers can enhance customer satisfaction and loyalty, driving long-term growth and success.

Allianz’s eAZy Connect platform offers a seamless digital onboarding process, enhancing the customer experience and reducing processing times. The platform provides a user-friendly interface for policy applications, digital signatures, and real-time updates, making it easier for customers to purchase and manage insurance policies.

8. Insurtech Partnerships

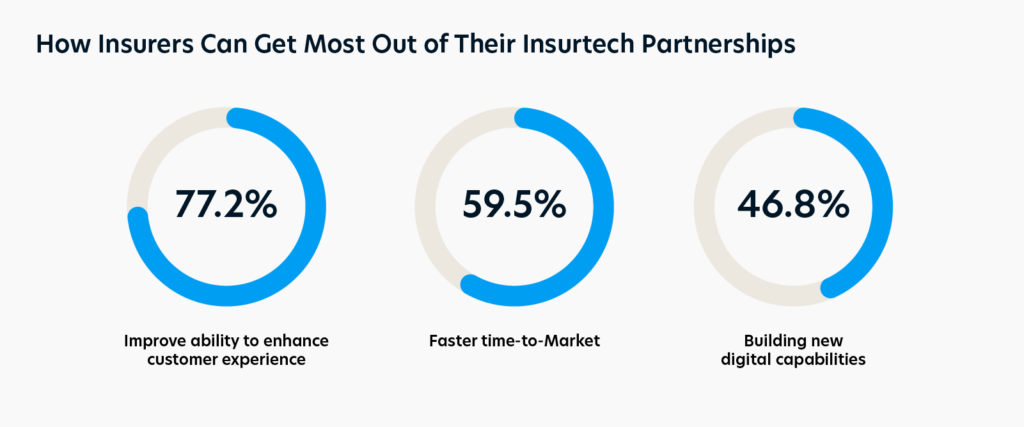

According to recent studies, 75% of insurers say they are exploring insurtech partnerships to develop new solutions. Collaborations with insurtech startups are accelerating innovation and digital transformation in the insurance industry. Insurtech firms bring agility, technological expertise, and fresh perspectives that complement the capabilities of traditional insurers. These partnerships enable insurers to adopt cutting-edge technologies, streamline operations, and enhance customer experiences. Insurtech partnerships are driving the development of innovative digital transformation solutions that help insurers stay competitive and meet evolving customer expectations.

9. Robotic Process Automation (RPA)

Robotic Process Automation (RPA) is streamlining repetitive and time-consuming tasks, such as data entry and claims processing, by automating these processes. This reduces operational costs and improves accuracy. A McKinsey report estimates that RPA can cut costs by up to 30% in insurance operations, demonstrating its significant impact. RPA bots can handle high-volume tasks with precision and speed, freeing up human employees to focus on more complex and value-added activities. This automation enhances productivity, reduces error rates, and accelerates service delivery, contributing to overall operational efficiency.

10. Growth of Hybrid Cloud

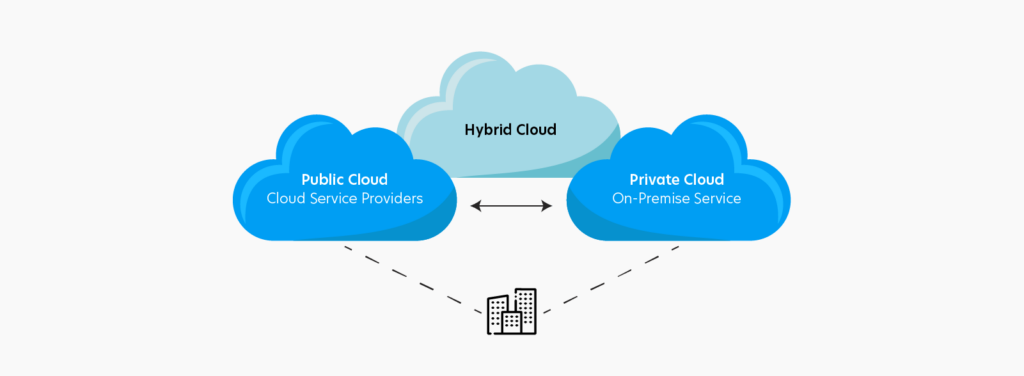

The hybrid cloud is becoming a strategic asset for insurers, offering a flexible and scalable IT infrastructure that supports innovation and agility. By combining private and public cloud environments, insurers can optimize their IT resources, reduce costs, and enhance data security. Hybrid cloud solutions enable insurers to quickly deploy new applications, improve disaster recovery capabilities, and scale operations to meet changing demands.

AXA, for instance, has adopted a hybrid cloud strategy to support its digital transformation initiatives. This approach allows AXA to innovate rapidly while ensuring data protection and regulatory compliance. The hybrid cloud is a key component of digital transformation services that enable insurers to stay competitive in a fast-evolving market.

The Bottom Line:

The landscape of the insurance industry is being reshaped at an unprecedented pace by digital transformation. As we look ahead to 2024, the convergence of technologies like AI, IoT, and blockchain promises to redefine how insurers engage with customers, manage risks, and drive operational efficiencies. According to McKinsey, digital transformation efforts have the potential to increase insurer profitability by up to 20% through cost reductions and improved customer retention.

As customers increasingly expect personalized experiences and seamless interactions, insurers must embrace these innovations to stay competitive. Quinnox, at the forefront of digital transformation services, empowers insurers to harness these technologies effectively. Through strategic partnerships and cutting-edge solutions for the insurance industry, Quinnox enables insurers to navigate the complexities of digital disruption with confidence.

Are you ready to transform your insurance operations and elevate customer satisfaction?

Connect with Us Today!

Explore more on elevating your customer experience journey!