How Quinnox Enhanced Shop Floor Safety with AI for a Leading Fragrance Company

Discover how Quinnox deployed cutting edge AI-driven solutions to enhance shop floor safety and minimized risks for a leading fragrance company.

Read moreA positive customer experience often translates into higher customer lifetime value and increased referrals, proving to be a key driver of sustainable growth.

AI-driven system leverages historical data and real-time inputs to forecast cash flow trends, identify potential shortfalls or surpluses, and optimize liquidity management.

Cash flow disruptions, inaccurate liquidity planning

AI/ML Approach: Predictive Analytics, Time Series Forecasting; Category: Supervised Learning; Key Methods: Regression, Neural Networks, Anomaly Detection

Improved liquidity planning and management, reduced risk of cash flow disruptions, enhanced decision-making with data-driven insights.

Improved cash flow forecasting accuracy, Reduction in liquidity shortfalls, Better financial decision-making

AI optimizes expense management by analyzing spending patterns, identifying anomalies, and forecasting future expenses. Automates expense categorization and provides proactive cost-saving recommendations.

Uncontrolled spending, inability to predict future expenses

AI/ML Approach: Predictive Analytics, Anomaly Detection; Category: Supervised Learning; Key Methods: Classification, Neural Networks, Pattern Recognition

Proactive expense management, enhanced fraud detection, reduced manual effort, improved cost control.

Reduction in unexpected expenses, Improved expense forecasting accuracy, Proactive cost savings, Reduced fraud

AI automates the creation of preliminary drafts for tasks like drafting contracts and supplementing credit reviews, reducing manual effort.

Manual effort in drafting financial documents, slow document processing

AI/ML Approach: Natural Language Processing, Text Generation; Category: Generative AI; Key Methods: Named Entity Recognition, Text Summarization

Increases operational efficiency, reduces costs, and speeds up finance operations.

Reduction in document drafting time, Lower labor costs

LLMs analyze contracts, identify risks, and suggest mitigation strategies while ensuring compliance with regulatory changes.

Manual contract analysis, risk identification delays

AI/ML Approach: Risk Analysis, Compliance Monitoring; Category: NLP-based Risk Management; Key Methods: Named Entity Recognition, Sentiment Analysis

Improves risk management, enhances accuracy in compliance, and reduces time and cost spent on manual contract analysis.

Reduced legal costs

AI system reconciles timesheet and service ticket data by detecting discrepancies, flagging issues, and suggesting corrections based on learned patterns, ensuring accurate billing and payroll processing.

Discrepancies in timesheet and service ticket data, manual reconciliation errors

AI/ML Approach: Anomaly Detection; Category: Predictive Analytics

Enhanced data accuracy, faster conflict resolution, reduced manual reconciliation efforts, and improved billing and payroll efficiency.

Reduction in data mismatches, Faster resolution of conflicts

An AI-driven AP & AR Management system streamlines proposal generation by automating tasks across project types and integrating data from financial systems and tools.

Manual reconciliation in AP and AR processes leads to inefficiencies and errors in financial reporting.

AI/ML Approach: Predictive Analytics; Category: Supervised Learning; Key Methods: Text Analysis, Regression, Automation

Optimize financial operations by streamlining Accounts Payable (AP) and Accounts Receivable (AR) processes to improve operational efficiency and financial accuracy.

Improved accuracy in financial reporting; Reduced invoice processing time; Increased on-time payments

System detects and flags fraudulent transactions by analyzing patterns, anomalies, and suspicious activities in real time, ensuring secure and reliable financial operations.

Unusual patterns and suspicious activities in financial transactions can go unnoticed without automated detection systems.

AI/ML Approach: Anomaly Detection, Predictive Analytics; Category: Supervised Learning, Unsupervised Learning; Key Methods: Clustering, Regression, Decision Trees

To enhance transaction security and minimize financial losses by detecting fraud in real-time.

Strengthened security measures, minimized financial impact from fraudulent activities, increased customer confidence

AI models monitor regulatory compliance by analyzing processes, comparing real-time activity to norms, and generating reports. Predictive analytics forecast potential compliance issues, enabling proactive risk mitigation. Gen AI automates compliance monitoring, ensuring operators and traders stay within risk limits and comply with regulations. Sentiment analysis monitors communications to detect signs of fatigue or stress, promoting health and reducing errors.

Difficulty ensuring real-time regulatory compliance, mitigating risks, and monitoring employee well-being leads to increased non-compliance risk and operational errors.

AI/ML Approach: Predictive Analytics, Anomaly Detection; Category: Regression, Text Analysis, Pattern Recognition

Faster and more accurate compliance reporting, reduced risk of non-compliance, proactive mitigation of compliance issues, improved employee well-being, and reduced operational errors.

Reduced compliance reporting time; Lowered non-compliance incidents; Enhanced employee monitoring accuracy; Improved proactive risk mitigation efforts.

AI automates the due diligence process by reviewing diverse data sources, assessing risks, and monitoring entities post-transaction. The system ensures faster evaluations, accurate risk assessments, and continuous tracking for enhanced risk management.

Manual and time-consuming due diligence processes hinder the ability to evaluate entities efficiently, increasing the risk of oversight and poor deal viability.

AI/ML Approach: Anomaly Detection, Risk Scoring; Category: Natural Language Processing, Classification

Enhance the efficiency of due diligence processes, enabling faster evaluations, accurate risk assessments, and proactive risk management to support better-informed decision-making and improved deal viability

Reduced due diligence processing time; Improved risk assessment accuracy; Increased early detection of potential risks; Enhanced continuous monitoring of entities post-transaction.

AI makes buy and sell decisions in financial markets by analyzing market trends, historical data, and real-time financial signals.

Manual trading processes struggle with real-time analysis, leading to missed opportunities and inefficient strategies.

AI/ML Approach: Predictive Analytics, Time Series Forecasting; Category: Supervised Learning; Key Methods: Regression, Neural Networks, Decision Trees

Enhancing trading efficiency by automating decision-making and optimizing strategies in financial markets.

Streamlined trading operations, reduced manual errors, improved strategy execution, and enhanced profitability.

AI analyzes financial portfolios to manage risk by evaluating market conditions, asset performance, and economic indicators.

Lack of tools to accurately evaluate market volatility, asset performance, and economic risks, leading to potential portfolio instability.

AI/ML Approach: Risk Analysis, Predictive Analytics; Category: Supervised Learning; Key Methods: Regression, Decision Trees, Monte Carlo Simulation

To enhance financial decision-making by effectively mitigating risks and stabilizing portfolios.

Reduced exposure to financial risks, improved portfolio performance, and better-informed investment decisions.

AI predicts economic trends and stock market movements by analyzing historical data, market indicators, and global events.

Absence of predictive tools to forecast economic trends and stock market movements, resulting in suboptimal investment decisions.

AI/ML Approach: Predictive Analytics; Category: Supervised Learning; Key Methods: Regression, Decision Trees, Time Series Forecasting

To improve investment strategies and financial planning by predicting market fluctuations.

Better investment strategies, improved financial planning, and more accurate market predictions.

AI tools offer automated investment and portfolio management services by analyzing customer profiles, risk tolerance, and market conditions.

Lack of personalized financial services and inefficiency in portfolio management leads to higher operational costs and suboptimal client satisfaction.

AI/ML Approach: Predictive Analytics; Category: Supervised Learning, Reinforcement Learning; Key Methods: Clustering, Decision Trees, Optimization Algorithms

To reduce operational costs while providing personalized financial services and improving portfolio performance.

Improved efficiency in portfolio management, higher client retention, and reduced manual intervention in financial advising.

AI provides tailored investment recommendations by analyzing customer data such as spending habits, financial goals, and market trends.

Lack of tailored financial advice results in lower customer satisfaction and suboptimal investment outcomes.

AI/ML Approach: Predictive Modeling; Category: Supervised Learning; Key Methods: Regression, Collaborative Filtering, Decision Trees

To enhance customer satisfaction through personalized financial recommendations and improve portfolio performance.

Increased customer engagement, improved investment portfolio returns, higher client retention due to personalized advice.

AI models assess the likelihood of loan defaults by analyzing historical credit data, market conditions, and customer behavior.

Loan default predictions and risk assessments are often slow or inaccurate, leading to financial exposure.

AI/ML Approach: Predictive Analytics, Risk Scoring; Category: Supervised Learning; Key Methods: Logistic Regression, Decision Trees, Feature Engineering

To enhance credit risk assessment accuracy and enable proactive decision-making in loan approvals.

Improved accuracy in credit risk assessments, better-informed lending decisions, reduced instances of loan defaults.

AI streamlines the loan approval process by analyzing applicants’ creditworthiness using financial history, risk assessment, and predictive analytics, reducing approval times and manual efforts.

Loan approval times are lengthy, and manual assessments can lead to errors, delaying decisions.

AI/ML Approach: Predictive Analytics, Risk Scoring; Category: Supervised Learning; Key Methods: Regression, Decision Trees, Feature Engineering

To streamline the loan approval process, improving efficiency and reducing manual effort.

Improved loan processing efficiency, minimized manual errors, faster approval times leading to enhanced customer experience.

AI automates claims validation and settlement by analyzing claim data and cross-referencing with policy details for faster and more accurate decisions.

Manual claims validation leads to delays and errors, affecting customer satisfaction and operational efficiency.

AI/ML Approach: Natural Language Processing, Predictive Analytics; Category: Supervised Learning; Key Methods: Text Classification, Anomaly Detection, Decision Trees

Reduces processing time, enhances accuracy, improves customer satisfaction

Faster claims processing, improved accuracy in claim validation, and increased customer satisfaction with quicker settlements.

AI tools analyze claims for anomalies and fraud by detecting suspicious patterns, inconsistencies, and abnormal claim behaviors.

Detecting fraudulent claims manually is time-consuming and prone to oversight, leading to financial losses.

AI/ML Approach: Anomaly Detection, Predictive Analytics; Category: Supervised Learning, Unsupervised Learning; Key Methods: Regression, Neural Networks, Decision Trees

Reduces fraudulent claims, lowers financial losses, and ensures accurate claim payouts

Improved accuracy in fraud detection, enhanced financial security

AI streamlines the underwriting process for efficiency by automating data collection, risk assessment, and decision-making.

Manual underwriting processes are time-intensive and prone to errors, affecting efficiency and accuracy.

AI/ML Approach: Predictive Analytics Category: Supervised Learning; Key Methods: Decision Trees, Regression, Natural Language Processing

To improves speed, accuracy, and cost-effectiveness of underwriting

Streamlined underwriting workflows, enhanced risk assessment accuracy, reduced processing times

AI tailors insurance products based on customer data by analyzing individual needs, preferences, and behaviors to offer suitable coverage.

Standard policy offerings often fail to meet diverse customer needs, leading to reduced engagement and higher churn.

AI/ML Approach: Data Analytics, Personalization; Category: Supervised Learning, Clustering; Key Methods: Classification, Decision Trees, Collaborative Filtering

Improves customer satisfaction, increases conversion rates, and reduces churn

Improved policy matching accuracy, higher customer retention rates, and increased policy uptake.

AI evaluates risk based on data analysis for underwriting by analyzing historical claims, demographics, and other relevant factors.

Manual risk evaluations are time-consuming and prone to errors, leading to inaccurate assessments and higher costs.

AI/ML Approach: Predictive Analytics; Category: Supervised Learning; Key Methods: Regression, Decision Trees, Clustering

Improve underwriting accuracy, reduce underwriting costs, and enhances risk management

Enhanced risk prediction accuracy, reduced underwriting costs

AI models predict potential claims for risk mitigation by analyzing historical data, weather patterns, and customer behaviors.

Organizations struggle to identify high-risk areas and predict potential claims using traditional methods, leading to preventable losses.

AI/ML Approach: Predictive Analytics; Category: Supervised Learning; Key Methods: Regression, Time Series Analysis, Clustering

To minimize future claims and financial losses

Enhanced risk identification, improved loss prevention measures, and reduced claim-related expenses.

AI uses vehicle sensors to offer personalized premiums by analyzing driving behaviors, mileage, and other vehicle data.

Traditional premium models fail to account for individual driving behaviors, leading to less accurate pricing and missed opportunities for customer engagement.

AI/ML Approach: Predictive Analytics, IoT Integration; Category: Supervised Learning, Clustering; Key Methods: Regression, Classification, Decision Trees

To provide accurate and personalized insurance premiums based on real-time driving behavior and vehicle data.

Improved premium accuracy, enhanced risk assessment, and increased customer satisfaction through behavior-based discounts.

AI predicts health outcomes for policyholders by analyzing medical history, lifestyle factors, and genetic data.

Traditional methods lack the predictive capability to foresee future health issues, leading to suboptimal coverage and higher claim costs.

AI/ML Approach: Pricing Optimization, Predictive Analytics; Category: Regression, Optimization

To optimize health insurance coverage by predicting potential health risks based on individual data.

Improved coverage accuracy, reduced claim costs, and enhanced health management by predicting potential health risks.

AI-powered voice assistants enable customers to perform banking tasks through voice commands, such as checking balances, transferring funds, or paying bills.

Customers struggle with time-consuming and complex banking processes, leading to reduced satisfaction.

AI/ML Approach: Natural Language Processing, Speech Recognition; Category: Rule-based Systems; Key Methods: Speech-to-Text Conversion, Intent Recognition, Text-to-Speech Synthesis

To improve customer accessibility and convenience by enabling voice-based banking services.

Enhanced customer experience, reduced wait times, decreased workload for human representatives.

AI helps customers with policy inquiries and claims updates by providing automated responses and real-time support via chat interfaces.

Customers face delays and inconsistencies when accessing policy details or claims updates through traditional methods.

AI/ML Approach: Natural Language Processing, Conversational AI; Category: LLMs; Key Methods: Text Generation, Named Entity Recognition, Intent Recognition

To enhance customer service efficiency by providing real-time, automated support for inquiries and claims updates.

Reduced response times, improved customer satisfaction, and increased efficiency in handling inquiries.

Discover how Quinnox deployed cutting edge AI-driven solutions to enhance shop floor safety and minimized risks for a leading fragrance company.

Read moreDiscover Quinnox's approach with AI-powered solutions for a leading HVAC company that helped them drive innovation for enhanced operations & system performance.

Read moreQuinnox streamlined regulatory compliance for a leading bank with AI-driven solutions, enhancing accuracy & efficiency in a dynamic regulatory environment.

Read moreQuinnox AI-driven automated dumpster image classification helped a leading environmental services firm improve operational efficiency & enhance customer service.

Read moreDiscover how Quinnox utilized Gen-AI powered techniques to build recommended engine for fragrance & flavors industry client gaining 60-70% efficiency improvements.

Read moreExplore Quinnox's automation solutions that reduced process time for financial services firm by 40%, manual intervention by 80% & enhanced operational efficiency.

Read moreDiscover Quinnox’s ML-based pricing engine that helped a leading US bottler achieve significant revenue gains with optimal pricing & maximize customer satisfaction.

Read moreDiscover Quinnox's innovative approach with AI solution to a leading supply chain management firm resulting in enhanced customer service & operational efficiency.

Read moreDiscover how Quinnox deployed cutting edge AI-driven solutions to enhance shop floor safety and minimized risks for a leading fragrance company.

Read moreDiscover Quinnox's approach with AI-powered solutions for a leading HVAC company that helped them drive innovation for enhanced operations & system performance.

Read moreQuinnox streamlined regulatory compliance for a leading bank with AI-driven solutions, enhancing accuracy & efficiency in a dynamic regulatory environment.

Read moreDownload the ISG Provider Lens® Report on AMS Platforms.

Download Report

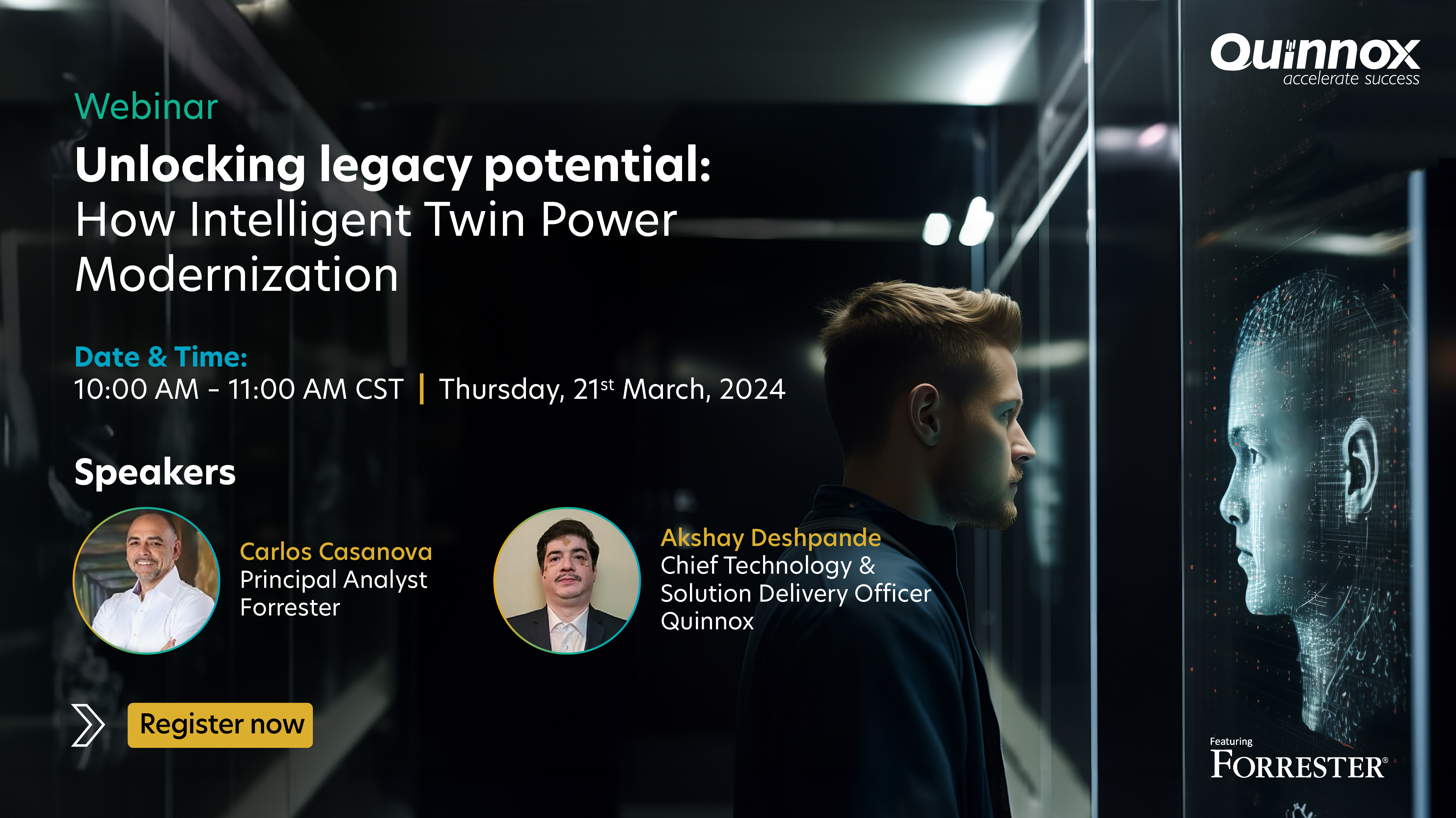

Join Carlos Casanova (Forrester) for a webinar on AIOps & Intelligent Twin Power! Master modernization, harness AIOps, achieve impactful outcomes. Seats limited – Reserve now!

Register for webinar

Get in touch with Quinnox Inc to understand how we can accelerate success for you.